Question: Suppose that Warner Co is a U . S . - based MNC with a major subsidiary in France. This French subsidiary deals in euros,

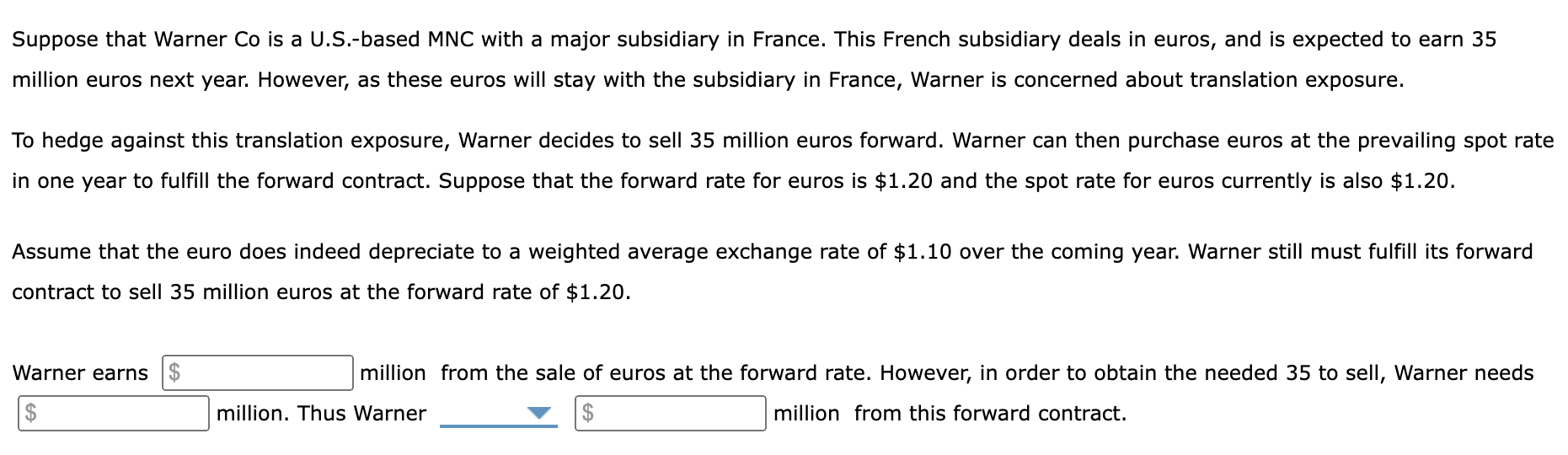

Suppose that Warner Co is a USbased MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn

million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure.

To hedge against this translation exposure, Warner decides to sell million euros forward. Warner can then purchase euros at the prevailing spot rate

in one year to fulfill the forward contract. Suppose that the forward rate for euros is $ and the spot rate for euros curren is also $

Assume that the euro does indeed depreciate to a weighted average exchange rate of $ over the coming year. Warner still must fulfill its forward

contract to sell million euros at the forward rate of $

Warner earns

million from the sale of euros at the forward rate. However, in order to obtain the needed to sell, Warner needs

million. Thus Warner million from this forward contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock