Question: Suppose that Washington Co. is a U.S. based MNC that is considering acquiring a target firm in Canada, which Washington would sell after three years.

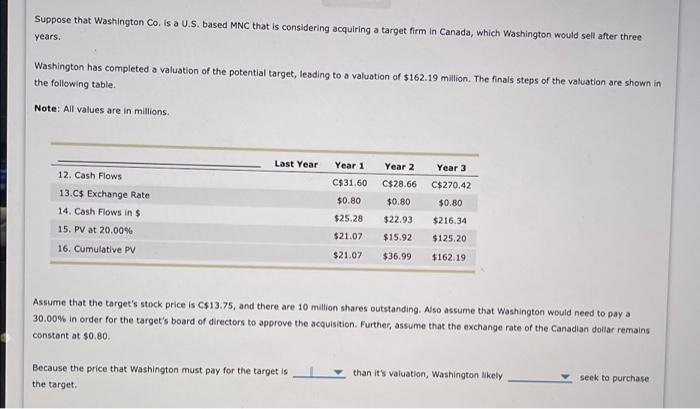

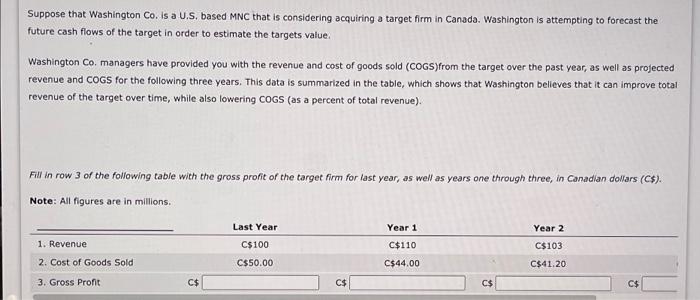

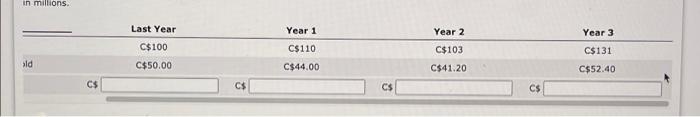

Suppose that Washington Co. is a U.S. based MNC that is considering acquiring a target firm in Canada, which Washington would sell after three years. Washington has completed a valuation of the potential target, leading to a valuation of $162.19 million. The finals steps of the valuation are shown in the following table Note: All values are in millions Last Year Year 1 Year 2 C$28.66 12. Cash Flows 13.C$ Exchange Rate 14. Cash Flows in $ 15. PV at 20.00% C$31.60 $0.80 Year 3 C$270.42 $0.80 $216.34 $125,20 $0.80 $22.93 $15.92 $25.28 $21.07 16. Cumulative PV $21.07 $36.99 $162.19 Assume that the target's stock price is $13.75, and there are 10 million shares outstanding. Also assume that Washington would need to pay a 30.00% in order for the target's board of directors to approve the acquisition. Further, assume that the exchange rate of the Canadian dollar remains constant at $0.80 Because the price that Washington must pay for the target is the target. than it's valuation, Washington likely seek to purchase Suppose that Washington Co. is a U.S. based MNC that is considering acquiring a target firm in Canada. Washington Is attempting to forecast the future cash flows of the target in order to estimate the targets value. Washington Co. managers have provided you with the revenue and cost of goods sold (COGS)from the target over the past year, as well as projected revenue and COGS for the following three years. This data is summarized in the table, which shows that Washington believes that it can improve total revenue of the target over time, while also lowering COGS (as a percent of total revenue). Fill in row 3 of the following table with the gross profit of the target firm for last year, as well as years one through three, in Canadian dollars (C$). Note: All figures are in millions. Last Year Year 2 Year 1 C$110 C$103 1. Revenue 2. Cost of Goods Sold C$100 C$50.00 C$44.00 C$41.20 3. Gross Profit C$ C$ C$ C$ in millions Year 1 Year 3 Last Year C$100 C$110 Year 2 C$103 C$41.20 C$131 old C$50.00 C$44.00 C$52.40 C$ C$ C$ C$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts