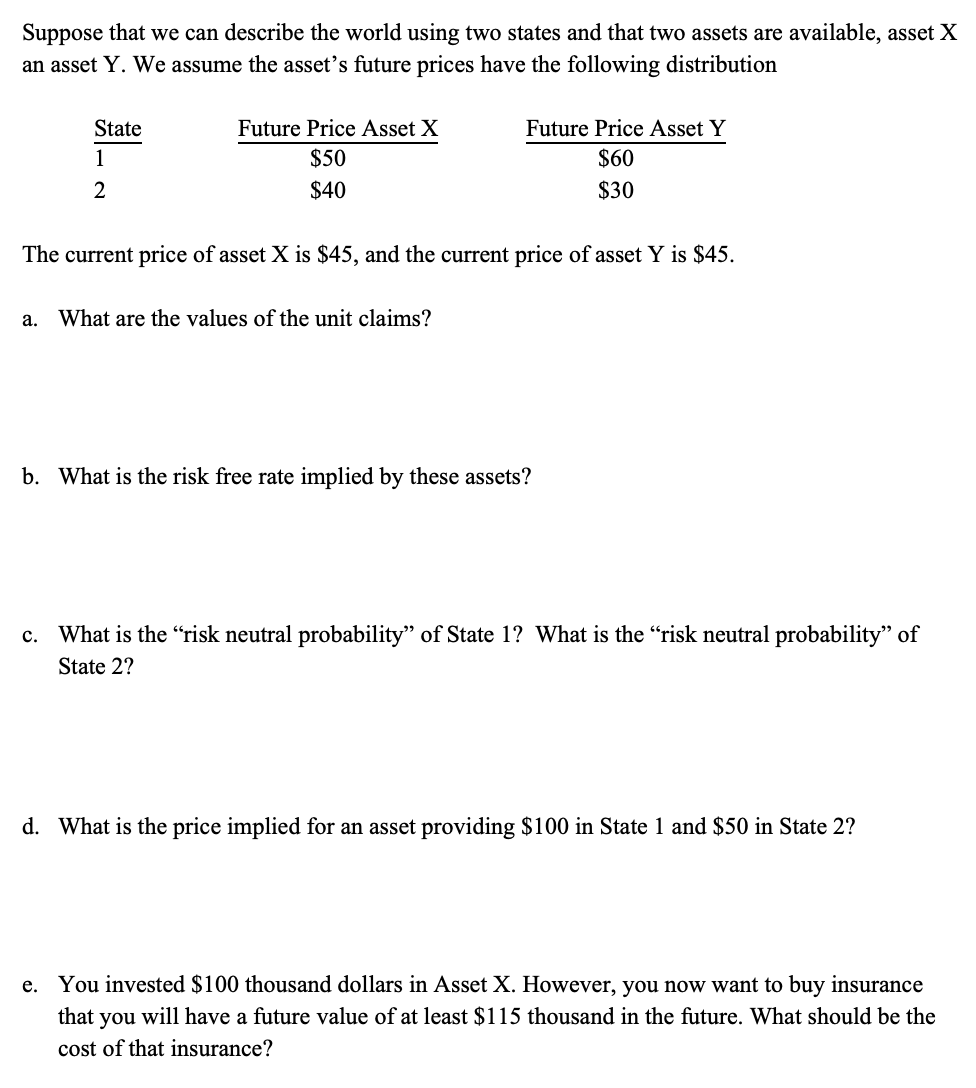

Question: Suppose that we can describe the world using two states and that two assets are available, asset X an asset Y. We assume the asset's

Suppose that we can describe the world using two states and that two assets are available, asset X an asset Y. We assume the asset's future prices have the following distribution State Future Price Asset X $50 $40 Future Price Asset Y $60 $30 N The current price of asset X is $45, and the current price of asset Y is $45. a. What are the values of the unit claims? b. What is the risk free rate implied by these assets? c. What is the "risk neutral probability of State 1? What is the "risk neutral probability" of State 2? . State as the ti d. What is the price implied for an asset providing $100 in State 1 and $50 in State 2? e. You invested $100 thousand dollars in Asset X. However, you now want to buy insurance that you will have a future value of at least $115 thousand in the future. What should be the cost of that insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts