Question: Suppose that we want to implement the Treynor-Black model. Given the following information, calculate the Sharpe ratio of the optimal risky portfolio, consisting of an

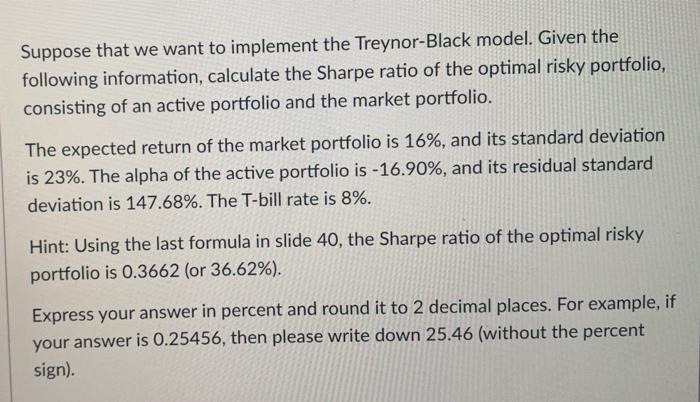

Suppose that we want to implement the Treynor-Black model. Given the following information, calculate the Sharpe ratio of the optimal risky portfolio, consisting of an active portfolio and the market portfolio. The expected return of the market portfolio is 16%, and its standard deviation is 23%. The alpha of the active portfolio is 16.90%, and its residual standard deviation is 147.68%. The T-bill rate is 8%. Hint: Using the last formula in slide 40 , the Sharpe ratio of the optimal risky portfolio is 0.3662 (or 36.62% ). Express your answer in percent and round it to 2 decimal places. For example, if your answer is 0.25456 , then please write down 25.46 (without the percent sign)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts