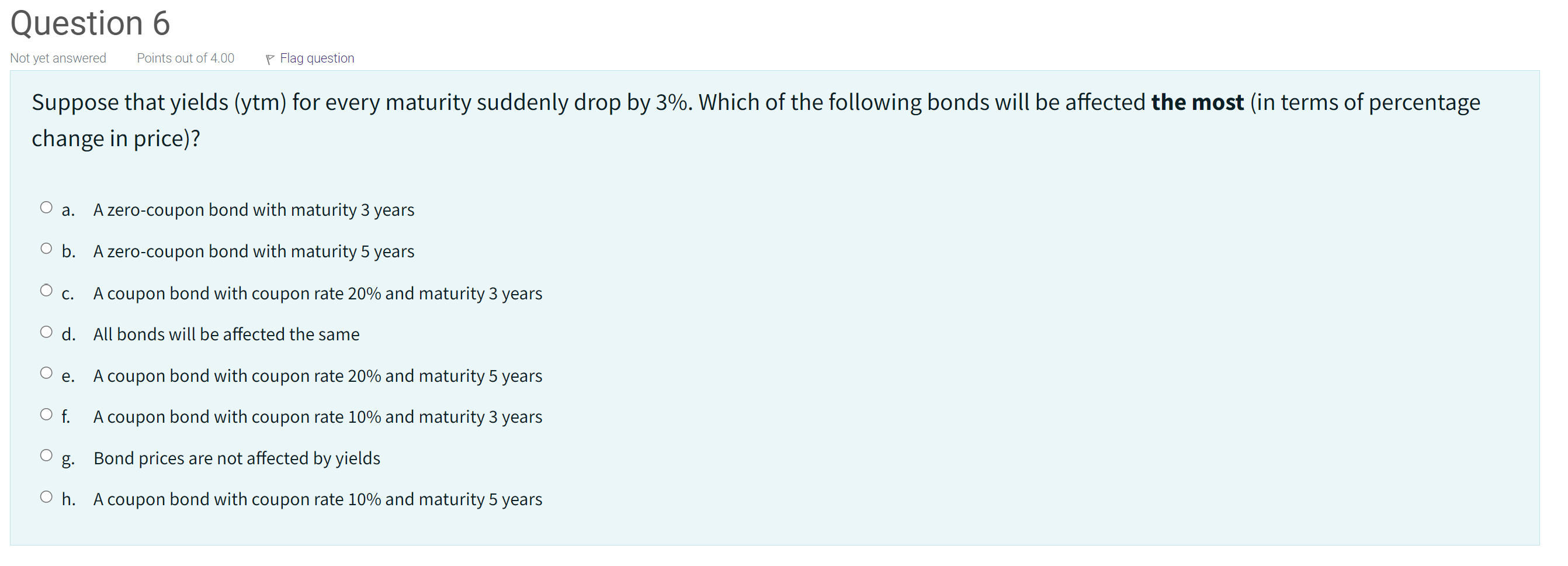

Question: Suppose that yields ( ytm ) for every maturity suddenly drop by 3 % . Which of the following bonds will be affected the most

Suppose that yields ytm for every maturity suddenly drop by Which of the following bonds will be affected the most in terms of percentage

change in price

a A zerocoupon bond with maturity years

b A zerocoupon bond with maturity years

c A coupon bond with coupon rate and maturity years

d All bonds will be affected the same

e A coupon bond with coupon rate and maturity years

f A coupon bond with coupon rate and maturity years

g Bond prices are not affected by yields

h A coupon bond with coupon rate and maturity years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock