Question: Suppose that you are considering borrowing $175,000 using a 30-year loan with an annual interest rate of 4% with monthly payments and compounding. The lender

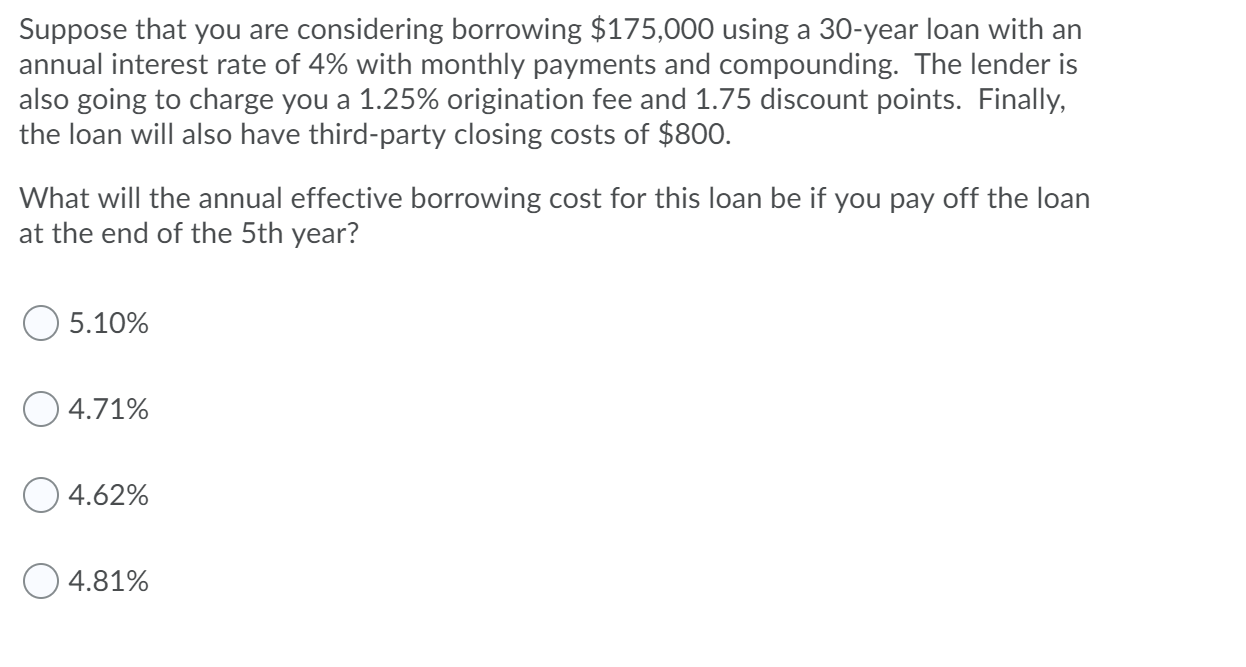

Suppose that you are considering borrowing $175,000 using a 30-year loan with an annual interest rate of 4% with monthly payments and compounding. The lender is also going to charge you a 1.25% origination fee and 1.75 discount points. Finally, the loan will also have third-party closing costs of $800. What will the annual effective borrowing cost for this loan be if you pay off the loan at the end of the 5th year? 05.10% 04.71% 04.62% 4.81%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts