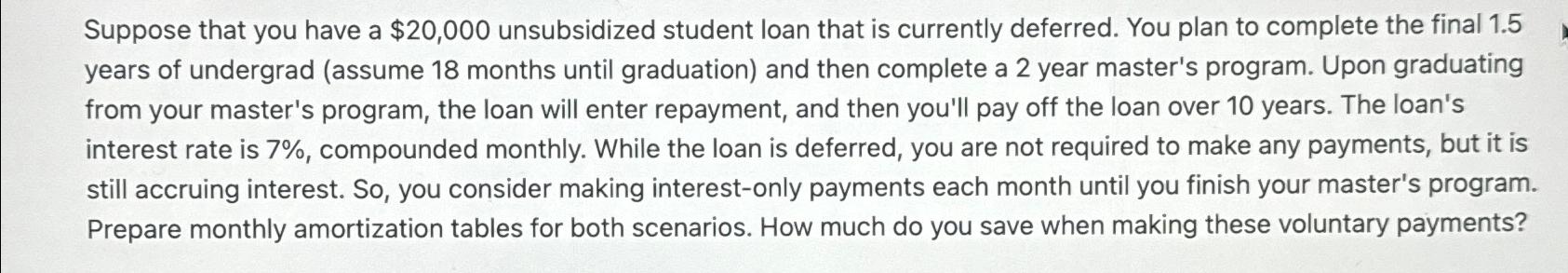

Question: Suppose that you have a $ 2 0 , 0 0 0 unsubsidized student loan that is currently deferred. You plan to complete the final

Suppose that you have a $ unsubsidized student loan that is currently deferred. You plan to complete the final years of undergrad assume months until graduation and then complete a year master's program. Upon graduating from your master's program, the loan will enter repayment, and then you'll pay off the loan over years. The loan's interest rate is compounded monthly. While the loan is deferred, you are not required to make any payments, but it is still accruing interest. So you consider making interestonly payments each month until you finish your master's program. Prepare monthly amortization tables for both scenarios. How much do you save when making these voluntary payments?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock