Question: - Suppose that you have estimated the expected returns and betas of the following five stocks by using annual data. Beta Expected Return (%) Stock

-

-

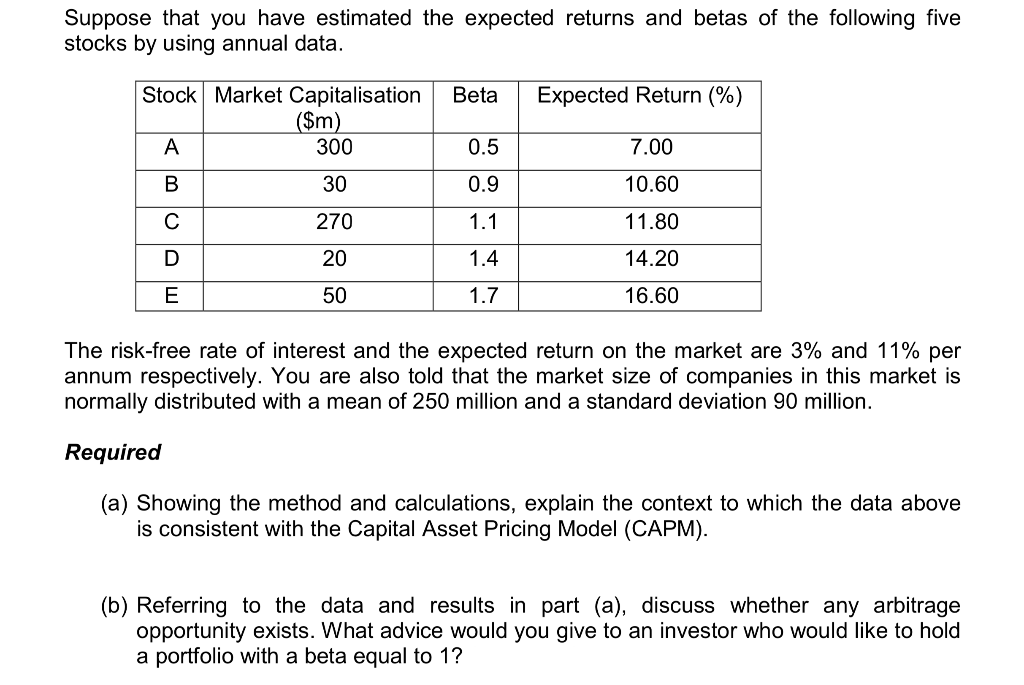

Suppose that you have estimated the expected returns and betas of the following five stocks by using annual data. Beta Expected Return (%) Stock Market Capitalisation ($m) A 300 0.5 7.00 B 30 0.9 10.60 C 270 1.1 11.80 D 20 1.4 14.20 E 50 1.7 16.60 The risk-free rate of interest and the expected return on the market are 3% and 11% per annum respectively. You are also told that the market size of companies in this market is normally distributed with a mean of 250 million and a standard deviation 90 million. Required (a) Showing the method and calculations, explain the context to which the data above is consistent with the Capital Asset Pricing Model (CAPM). (b) Referring to the data and results in part (a), discuss whether any arbitrage opportunity exists. What advice would you give to an investor who would like to hold a portfolio with a beta equal to 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts