Question: Suppose that your current machine is outdated, as the Chief Financial Officer, you feel that the firm would benefit from replacing the current machine. You

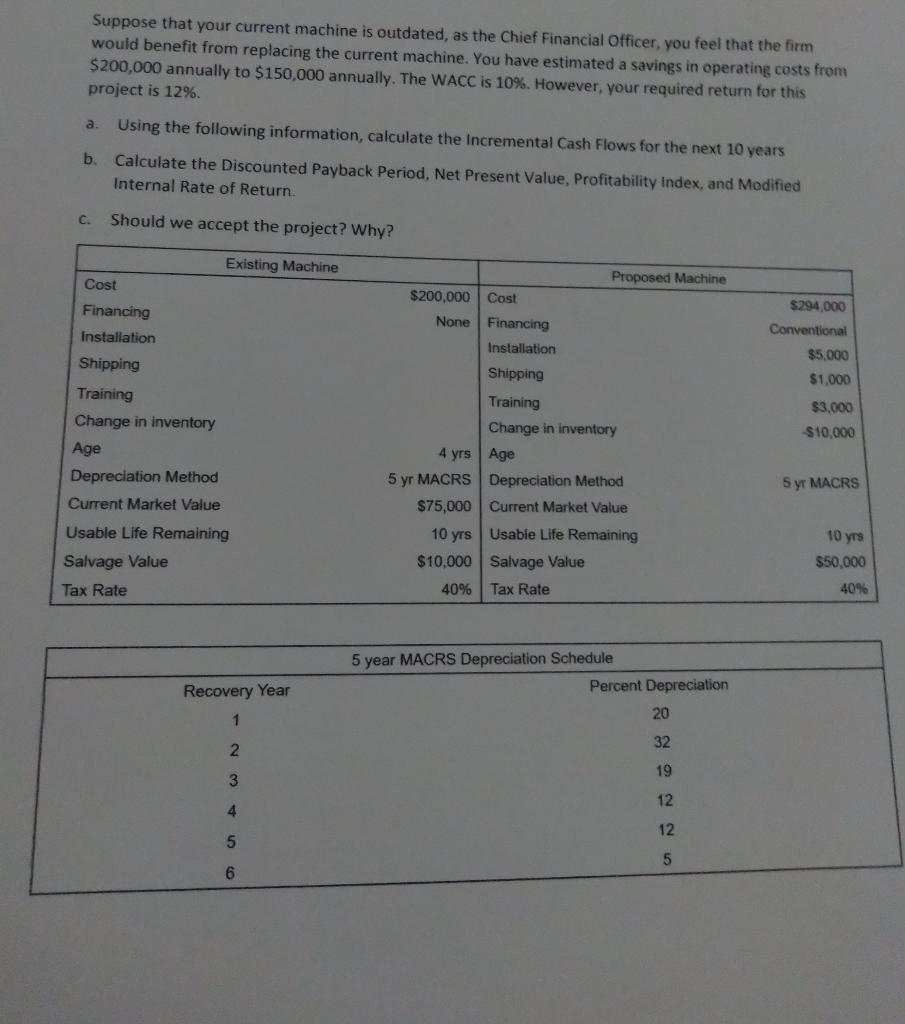

Suppose that your current machine is outdated, as the Chief Financial Officer, you feel that the firm would benefit from replacing the current machine. You have estimated a savings in operating costs from $200,000 annually to $150,000 annually. The WACC is 10%. However, your required return for this project is 12%. a. Using the following information, calculate the incremental Cash Flows for the next 10 years b. Calculate the Discounted Payback Period, Net Present Value, Profitability Index, and Modified Internal Rate of Return C. Should we accept the project? Why? Existing Machine Cost Financing Installation Shipping $294.000 Conventional $5,000 $1,000 Proposed Machine $200,000 Cost None Financing Installation Shipping Training Change in inventory 4 yrs Age 5 yr MACRS Depreciation Method $75,000 Current Market Value 10 yrs Usabie Life Remaining $10,000 Salvage Value Tax Rate Training Change in inventory Age Depreciation Method Current Market Value Usable Life Remaining Salvage Value Tax Rate $3.000 $10,000 5 yr MACRS 10 yrs $50,000 40% 40% Recovery Year 5 year MACRS Depreciation Schedule Percent Depreciation 20 1 32 2 19 3 12 4 12 5 5 6 Suppose that your current machine is outdated, as the Chief Financial Officer, you feel that the firm would benefit from replacing the current machine. You have estimated a savings in operating costs from $200,000 annually to $150,000 annually. The WACC is 10%. However, your required return for this project is 12%. a. Using the following information, calculate the incremental Cash Flows for the next 10 years b. Calculate the Discounted Payback Period, Net Present Value, Profitability Index, and Modified Internal Rate of Return C. Should we accept the project? Why? Existing Machine Cost Financing Installation Shipping $294.000 Conventional $5,000 $1,000 Proposed Machine $200,000 Cost None Financing Installation Shipping Training Change in inventory 4 yrs Age 5 yr MACRS Depreciation Method $75,000 Current Market Value 10 yrs Usabie Life Remaining $10,000 Salvage Value Tax Rate Training Change in inventory Age Depreciation Method Current Market Value Usable Life Remaining Salvage Value Tax Rate $3.000 $10,000 5 yr MACRS 10 yrs $50,000 40% 40% Recovery Year 5 year MACRS Depreciation Schedule Percent Depreciation 20 1 32 2 19 3 12 4 12 5 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts