Question: Suppose the average return on T-Bills was 1%. The average factor risk premiums are the following: market (MKT): 6% size (SMB): 2% value (HML):

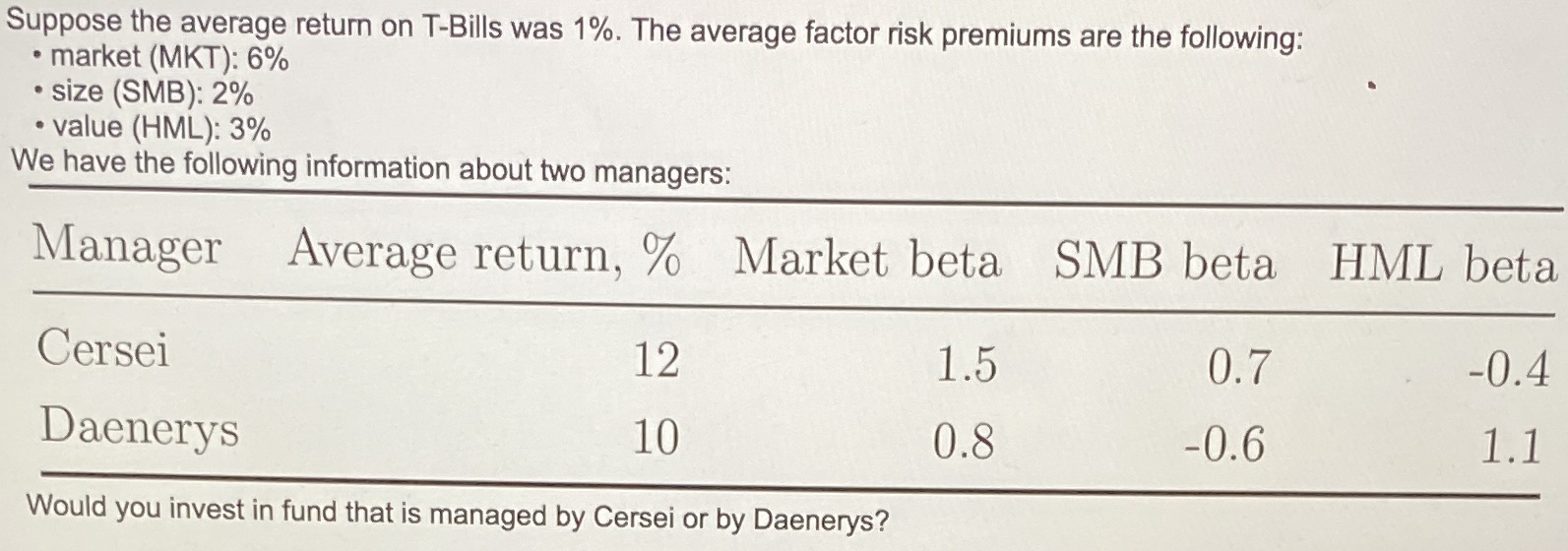

Suppose the average return on T-Bills was 1%. The average factor risk premiums are the following: market (MKT): 6% size (SMB): 2% value (HML): 3% We have the following information about two managers: Manager Average return, % Market beta SMB beta HML beta Cersei 12 1.5 0.7 -0.4 Daenerys 10 0.8 -0.6 1.1 Would you invest in fund that is managed by Cersei or by Daenerys?

Step by Step Solution

There are 3 Steps involved in it

To determine whether to invest in the fund managed by Cersei or by Daenerys we can calculate the exp... View full answer

Get step-by-step solutions from verified subject matter experts