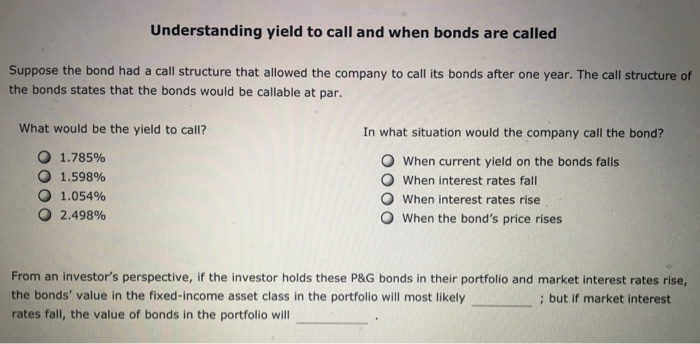

Question: Suppose the bond had a call structure that allowed the company to call its bonds after one year. The call structure of the bonds states

Suppose the bond had a call structure that allowed the company to call its bonds after one year. The call structure of the bonds states that the bonds would be callable at par. what would be the yield to call? 1.785% 1.598% 1.054% 2.498% In what situation would the company call the bond? When current yield on the bonds falls When interest rates fall When interest rates rise When the bond's price rises From an investor's perspective, if the investor holds these P&G bonds in their portfolio and market interest rates rise, the bonds' value in the fixed-income asset class in the portfolio will most likely; but if market interest rates fall, the value of bonds in the portfolio will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts