Question: Suppose the following balance sheet for Winbnb after second round of venture financing. Second Stage Market Value Balance Sheet ($mil) Suppose the company is able

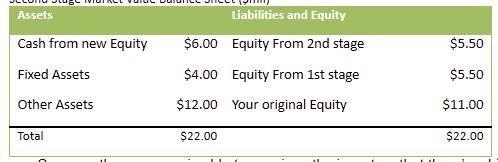

Suppose the following balance sheet for Winbnb after second round of venture financing.

Second Stage Market Value Balance Sheet ($mil)

Suppose the company is able to convince the investors that theres a big market for the company and wants to negotiate the third round venture financing. Now lets assume that new investors decide to invest $15 million and require 20% of the company.

- What will be the total value of the company after this new round of financing? _____(sample answer: $30.60m)

- What will be the equity for the 1st stage investor? ________(sample answer: $30.60m)

- What will be the equity for the 2nd stage investor?________ (sample answer: $30.60m)

- What will be the equity for the original investor? __________(sample answer: $30.60m)

Assets Cash from new Equity Liabilities and Equity $6.00 Equity From 2nd stage $4.00 Equity From 1st stage $5.50 Fixed Assets $5.50 Other Assets $12.00 Your original Equity $11.00 Total $22.00 $22.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock