Question: Suppose the following table represents the expected monthly return and the standard deviation of portfolio you currently hold, and a mutual fund you are thinking

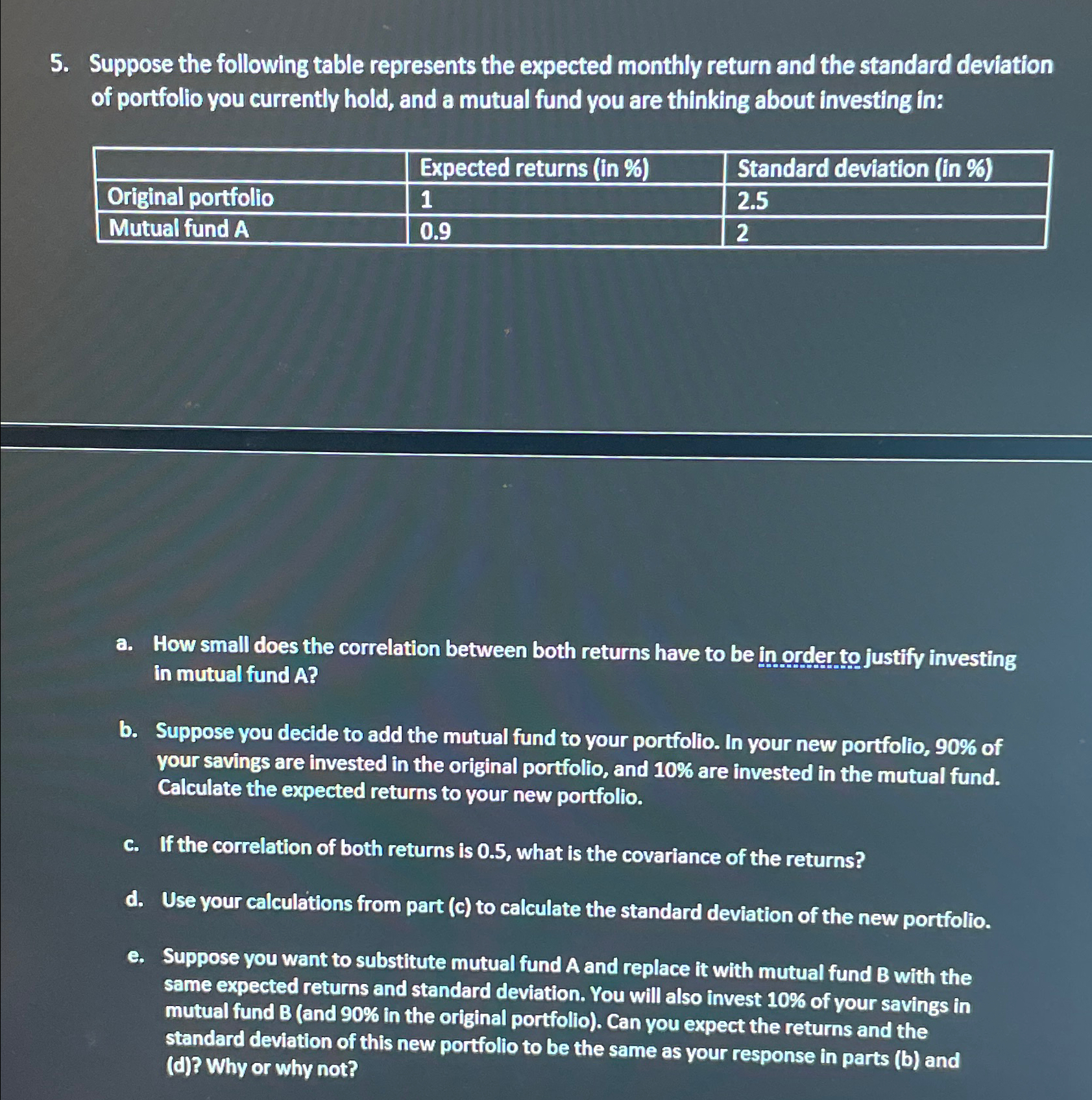

Suppose the following table represents the expected monthly return and the standard deviation of portfolio you currently hold, and a mutual fund you are thinking about investing in:

tableExpected returns in Standard deviation in Original portfolio,Mutual fund A

a How small does the correlation between both returns have to be in order to justify investing in mutual fund

b Suppose you decide to add the mutual fund to your portfolio. In your new portfolio, of your savings are invested in the original portfolio, and are invested in the mutual fund. Calculate the expected returns to your new portfolio.

c If the correlation of both returns is what is the covariance of the returns?

d Use your calculations from part c to calculate the standard deviation of the new portfolio.

e Suppose you want to substitute mutual fund A and replace it with mutual fund with the same expected returns and standard deviation. You will also invest of your savings in mutual fund B and in the original portfolio Can you expect the returns and the standard deviation of this new portfolio to be the same as your response in parts b and d Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock