Question: Suppose the risk - free return is 5 . 4 9 % and the market portfolio has an expected return of 8 . 2 1

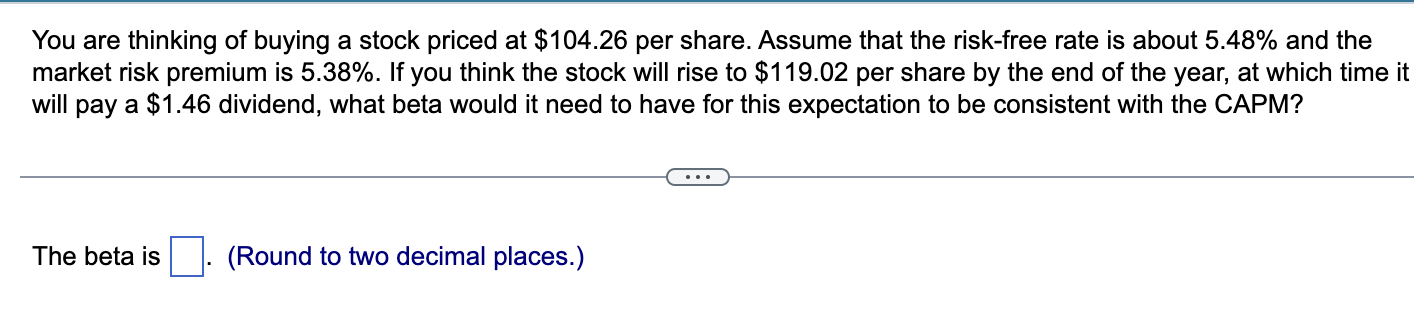

Suppose the riskfree return is and the market portfolio has an expected return of and a standard deviationEJH has a beta of CSH has a beta of and KMS has a beta of If you put of your money in EJH,You are thinking of buying a stock priced at $ per share. Assume that the riskfree rate is about and the

market risk premium is If you think the stock will rise to $ per share by the end of the year, at which time it

will pay a $ dividend, what beta would it need to have for this expectation to be consistent with the CAPM?

The beta is Round to two decimal places.

in and in KMS what is the beta of your portfolio?

The beta of your portfolio is

Round to two decimal places.

of Pepsico stock has a beta of What is its expected return?

The expected return of Pepsico stock is

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock