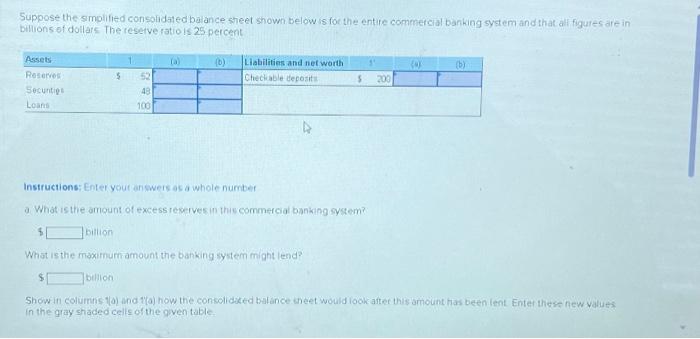

Question: Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The

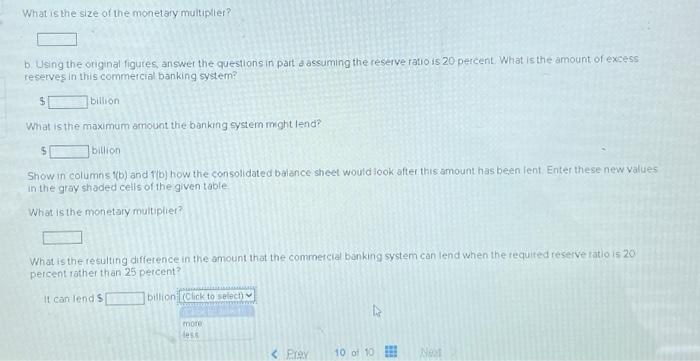

Suppose the smplified consolidated bulance sheet shown below is for the entire commetcial banking system and that al figures are in billions of dollars The resetve ratio is 25 percent Instructions: Enter yout an wers as a whole number a. What is the amount of excess recerves in this commercial banking system? $bition What is the maximumamount the banking system might lend? $belition In the gay shaded cells of the given table. What is the size of the monet ary multipller? b Using the original figures, answer the questions in part a assuming the reserve ratio is 20 percent. What is the amount of excess reserves in this commercial banking system? \$ billion What is the maximum amount the banking system mght lend? $ billion Show in columns 1(b) and 1(b) how the consol dated baiance sheet would look after this amount has been ient Enter these new values in the gray shaded celis of the given table What is the monetary multiplier? What is the resulting difference in the amount that the commetcial banking system can lend when the required reserve ratio is 20 percent rather than 25 percent? It cantends bition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts