Question: Suppose the U.S. yield curve is flat at 3% and the euro yield curve is flat at 4%. The current exchange rate is $135 per

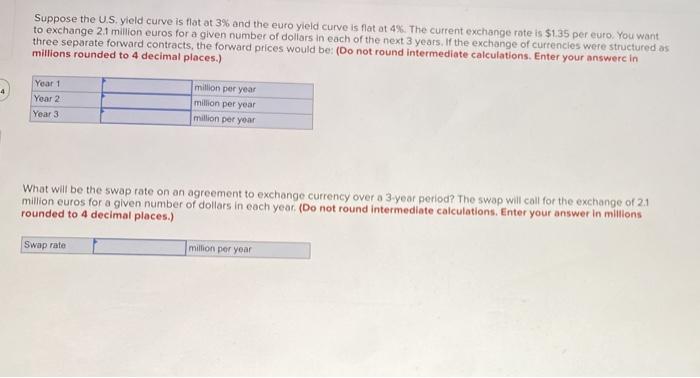

Suppose the U.S. yield curve is flat at 3% and the euro yield curve is flat at 4%. The current exchange rate is $135 per euro. You want to exchange 2.1 million euros for a given number of dollars in each of the next 3 years. If the exchange of currencies were structured as three separate forward contracts, the forward prices would be: (Do not round Intermediate calculations. Enter your answer in millions rounded to 4 decimal places.) Year 1 Year 2 Year 3 million per year million per year million per year What will be the swap rate on an agreement to exchange currency over a 3.year period? The swap will call for the exchange of 2.1 million euros for a given number of dollars in each year (Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places.) Swap rate million per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts