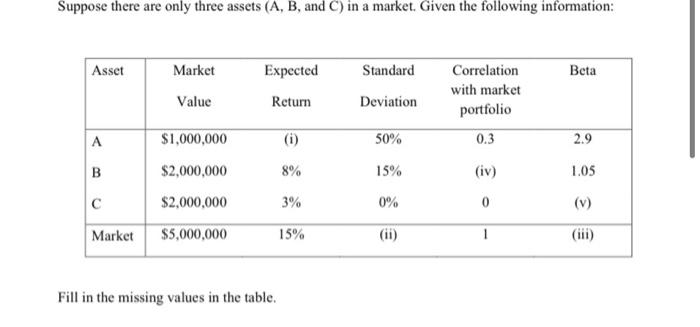

Question: Suppose there are only three assets (A, B, and C) in a market. Given the following information: Asset Market Expected Standard Beta Correlation with market

Suppose there are only three assets (A, B, and C) in a market. Given the following information: Asset Market Expected Standard Beta Correlation with market portfolio Value Return Deviation (i) 50% 0.3 2.9 B $1,000,000 $2,000,000 $2,000,000 8% 15% (iv) 1.05 3% 0% 0 (v) Market $5,000,000 15% (iii) Fill in the missing values in the table. Some Useful Formula 1. Present Value The Discount Value of T future Cash Flows PVC+++ 1+r (1+r)? -. **(1+ry' 2. Net Present Value NPV-PV-Cost Co - Cost NPV C, +, C *(1+1) 3. Perpetuity The value of C received each year, forever =C+E PVC 4. Annuity The value of Creceived each year for T years pv-[1-1(1+1) 3. Growing Perpetuity The value of a perpetuity that grows at rate g. where the first payment is C PVC A 6. Growing Annuity The value of a T-period annuity that grows at a rate g, where the first payment is C PV -- (1+ 11 r-8 (1+ 7. Measures of Risk for Individual Assets Var(R.) -0=Expected Value of (R-R) SDRA) - = VAR(R) Cov (RARE) Expected Value of (R4-R/R, -R) Corr (RA,Ra) = PAD = Cov (RA.Rey CAO 8. Expected Return on a Portfolio of Two Assets R, = x R +X,R, 9. Variance of a Portfolio of Two Assets 0; = x/xo +2x x,xox+X;xo} 10. Beta of stock i B: = (Pim)(o) / Om

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts