Question: Suppose we have a small interest rate (yield) move: = +0.01%. Calculate the new bond price + for + = + = 5.01% . Then

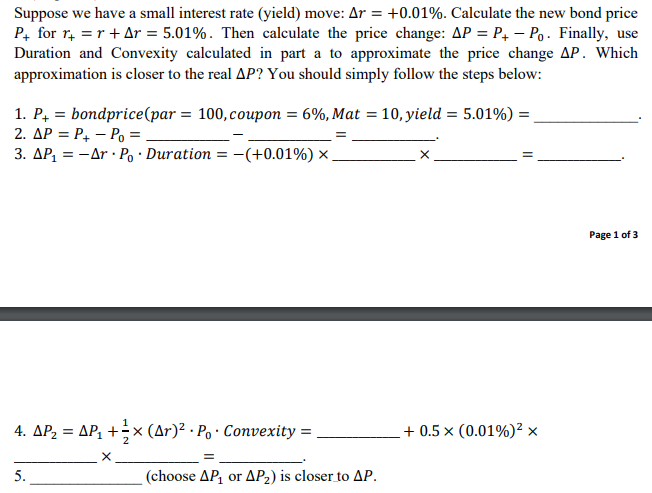

Suppose we have a small interest rate (yield) move: = +0.01%. Calculate the new bond price + for + = + = 5.01% . Then calculate the price change: = + 0 . Finally, use Duration and Convexity calculated in part a to approximate the price change . Which approximation is closer to the real ? You should simply follow the steps below:

1. + = ( = 100, = 6%, = 10, = 5.01%) = _____________.

2. = + 0 = ______________ ______________ = ______________.

3. 1 = 0 = (+0.01%) ______________ ______________ = ______________. Page 2 of 3

4. 2 = 1 + 1 2 () 2 0 = ______________ + 0.5 (0.01%) 2 ______________ ______________ = ______________.

5. ______________ (choose 1 or 2) is closer to .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts