Question: . - Suppose we have the two bonds below, both are semi-annual from issuers rated A+. You want to buy one of these bonds today

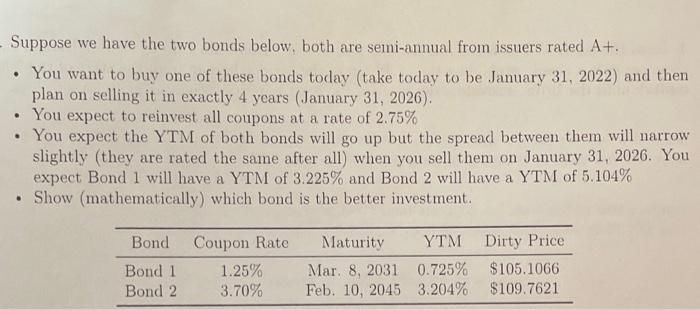

. - Suppose we have the two bonds below, both are semi-annual from issuers rated A+. You want to buy one of these bonds today (take today to be January 31, 2022) and then plan on selling it in exactly 4 years (January 31, 2026). You expect to reinvest all coupons at a rate of 2.75% You expect the YTM of both bonds will go up but the spread between them will narrow slightly (they are rated the same after all) when you sell them on January 31, 2026. You expect Bond 1 will have a YTM of 3.225% and Bond 2 will have a YTM of 5.104% Show (mathematically) which bond is the better investment. a Bond Bond 1 Bond 2 Coupon Rate 1.25% 3.70% Maturity YTM Mar. 8, 2031 0.725% Feb. 10, 2045 3.204% Dirty Price $105.1066 $109.7621 . - Suppose we have the two bonds below, both are semi-annual from issuers rated A+. You want to buy one of these bonds today (take today to be January 31, 2022) and then plan on selling it in exactly 4 years (January 31, 2026). You expect to reinvest all coupons at a rate of 2.75% You expect the YTM of both bonds will go up but the spread between them will narrow slightly (they are rated the same after all) when you sell them on January 31, 2026. You expect Bond 1 will have a YTM of 3.225% and Bond 2 will have a YTM of 5.104% Show (mathematically) which bond is the better investment. a Bond Bond 1 Bond 2 Coupon Rate 1.25% 3.70% Maturity YTM Mar. 8, 2031 0.725% Feb. 10, 2045 3.204% Dirty Price $105.1066 $109.7621

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts