Question: Suppose Yakov expects interest rates to decrease and purchases a call option on Treasury bond futures from Ana. The exercise price on Treasury bond futures

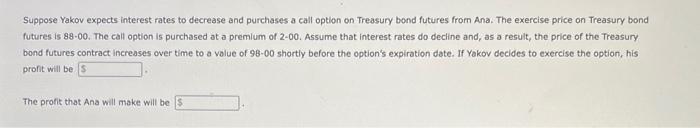

Suppose Yakov expects interest rates to decrease and purchases a call option on Treasury bond futures from Ana. The exercise price on Treasury bond futures is 88-00. The call option is purchased at a premium of 2-00. Assume that interest rates do decline and, as a result, the price of the Treasury bond futures contract Increases over time to a value of 98-00 shortly before the option's expiration date. If Yakov decides to exercise the option, his profit will be s The profit that Ana will make will be S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts