Question: Suppose you and most other investors expect the inflation rate to be 7% next year, to fall to 4% during the following year, and then

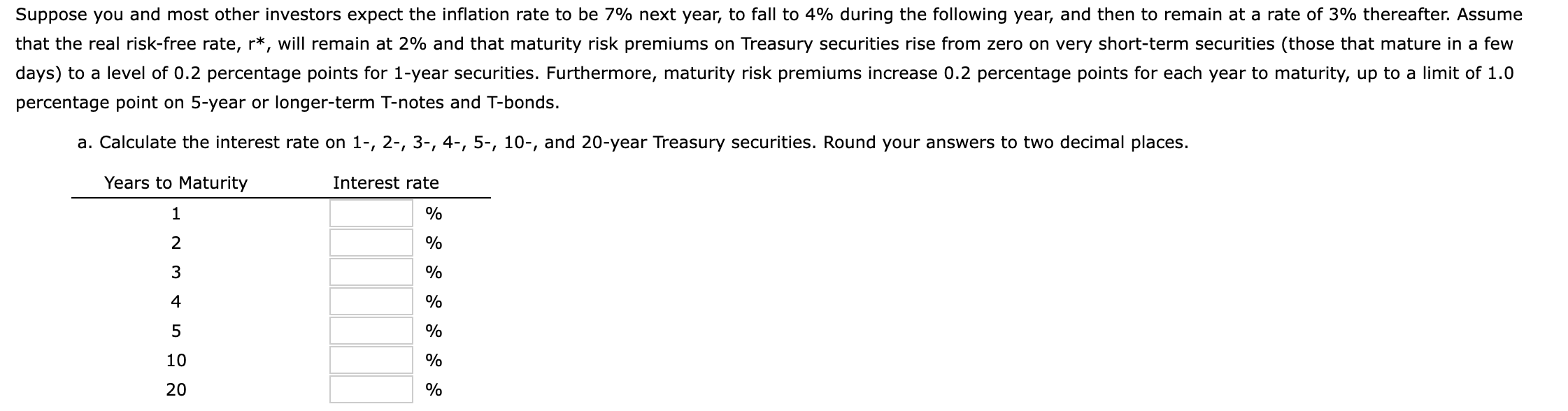

Suppose you and most other investors expect the inflation rate to be 7% next year, to fall to 4% during the following year, and then to remain at a rate of 3% thereafter. Assume that the real risk-free rate, r, will remain at 2% and that maturity risk premiums on Treasury securities rise from zero on very short-term securities (those that mature in a few days) to a level of 0.2 percentage points for 1-year securities. Furthermore, maturity risk premiums increase 0.2 percentage points for each year to maturity, up to a limit of 1.0 percentage point on 5-year or longer-term T-notes and T-bonds. a. Calculate the interest rate on 1-, 2-, 3-, 4-, 5-, 10-, and 20-year Treasury securities. Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts