Question: Suppose you are considering using the Adjusted Value Approach (APV) to assess the effect of leverage on the value of the firm named ACC.

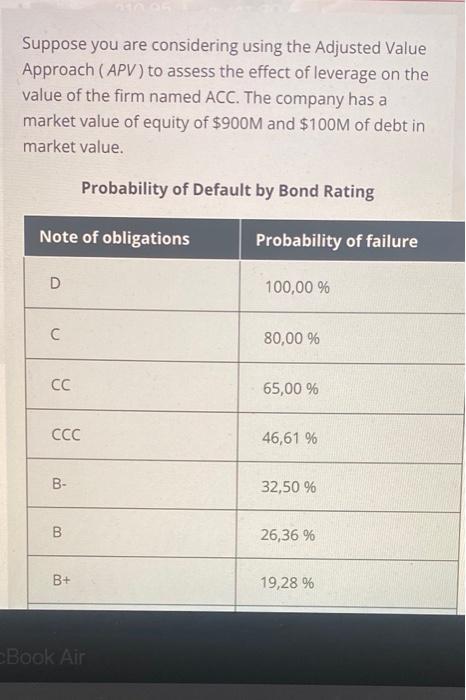

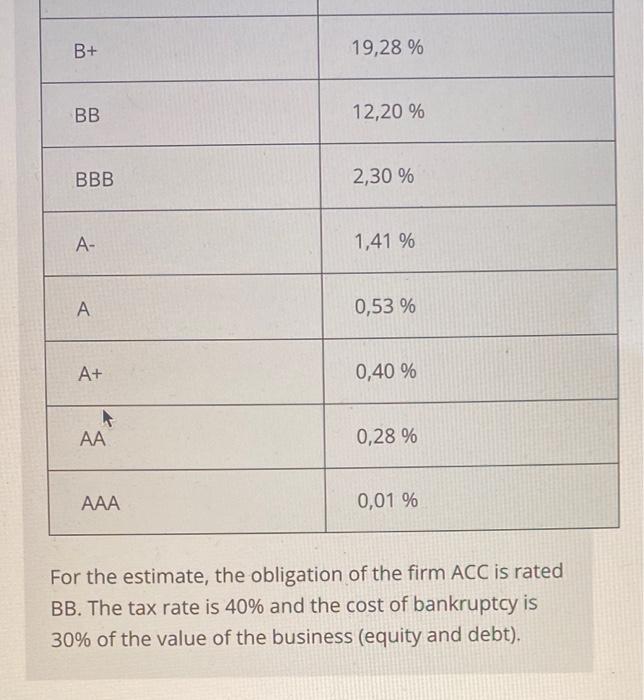

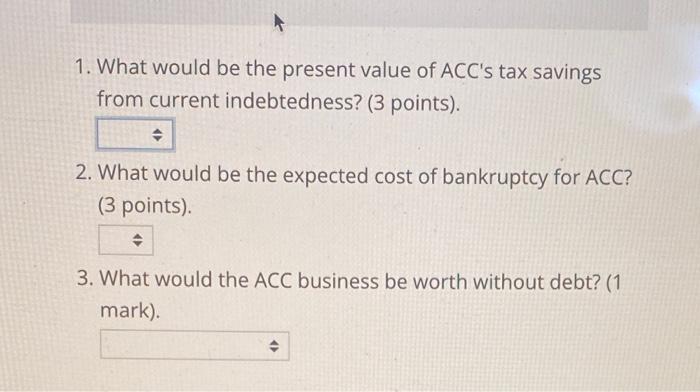

Suppose you are considering using the Adjusted Value Approach (APV) to assess the effect of leverage on the value of the firm named ACC. The company has a market value of equity of $900M and $100M of debt in market value. Probability of Default by Bond Rating Note of obligations D C CC CCC B- B B+ Book Air Probability of failure 100,00 % 80,00 % 65,00 % 46,61 % 32,50 % 26,36 % 19,28 % B+ BB BBB A- A A+ AA AAA 19,28 % 12,20 % 2,30 % 1,41% 0,53 % 0,40 % 0,28% 0,01 % For the estimate, the obligation of the firm ACC is rated BB. The tax rate is 40% and the cost of bankruptcy is 30% of the value of the business (equity and debt). 1. What would be the present value of ACC's tax savings from current indebtedness? (3 points). 2. What would be the expected cost of bankruptcy for ACC? (3 points). 3. What would the ACC business be worth without debt? (1 mark).

Step by Step Solution

There are 3 Steps involved in it

In order to answer the questions well use the information provided in the text and the images 1 What ... View full answer

Get step-by-step solutions from verified subject matter experts