Question: Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the

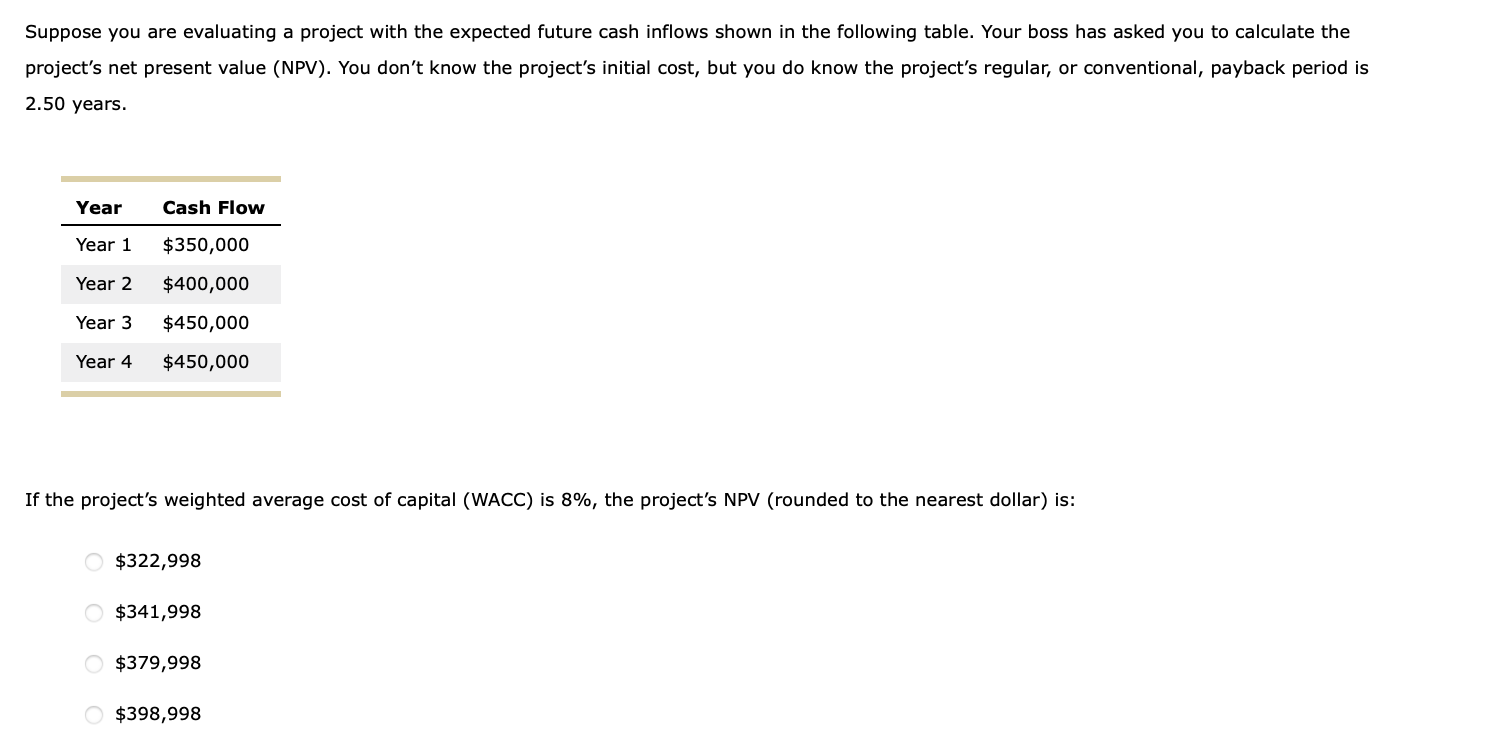

Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 8%, the project's NPV (rounded to the nearest dollar) is: $322,998$341,998$379,998$398,998

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts