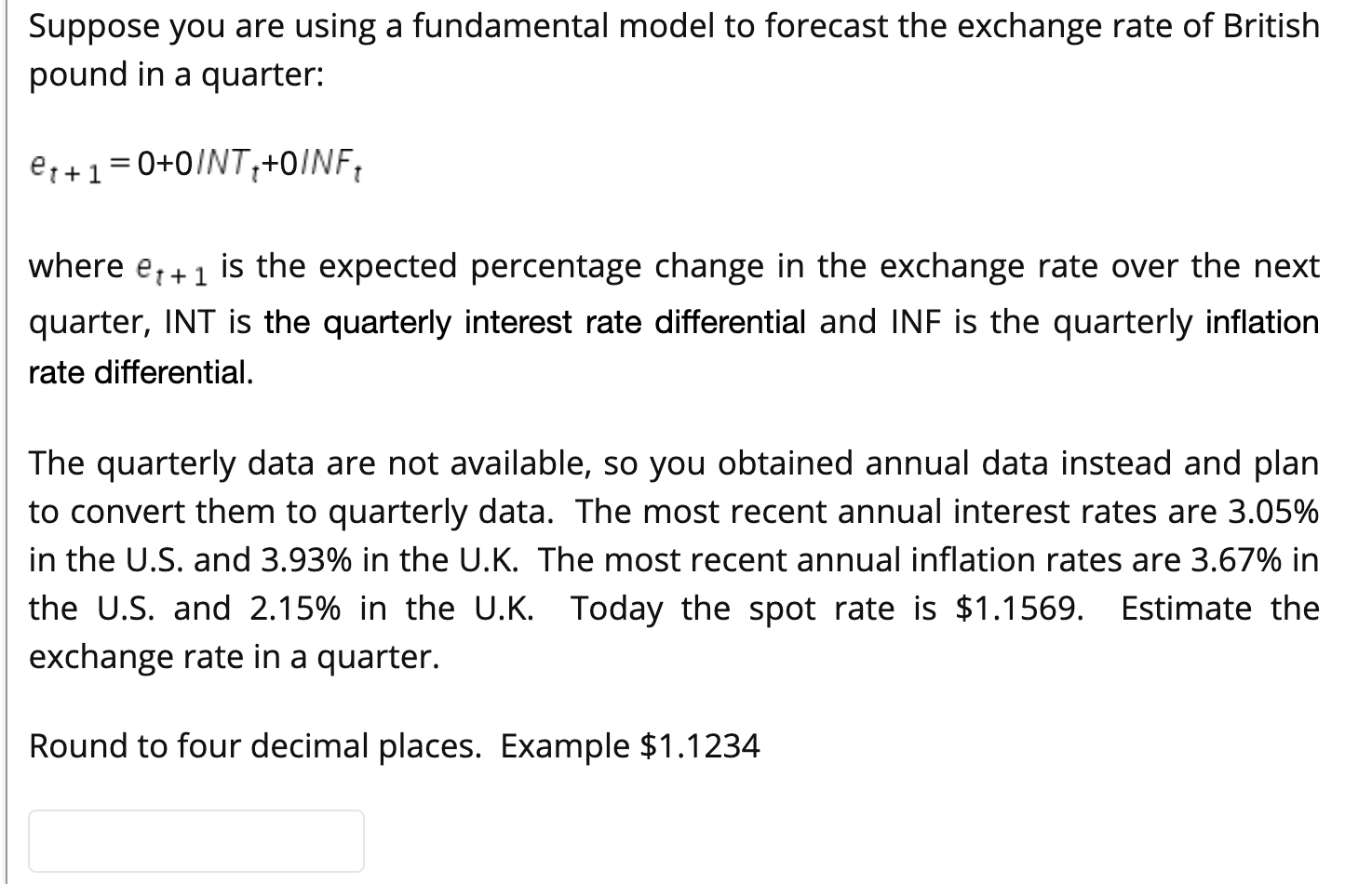

Question: Suppose you are using a fundamental model to forecast the exchange rate of British pound in a quarter: et+1 = 0+0/NTF+0/NF, et+1 where is the

Suppose you are using a fundamental model to forecast the exchange rate of British pound in a quarter: et+1 = 0+0/NTF+0/NF, et+1 where is the expected percentage change in the exchange rate over the next quarter, INT is the quarterly interest rate differential and INF is the quarterly inflation rate differential. The quarterly data are not available, so you obtained annual data instead and plan to convert them to quarterly data. The most recent annual interest rates are 3.05% in the U.S. and 3.93% in the U.K. The most recent annual inflation rates are 3.67% in the U.S. and 2.15% in the U.K. Today the spot rate is $1.1569. Estimate the exchange rate in a quarter. Round to four decimal places. Example $1.1234 Suppose you are using a fundamental model to forecast the exchange rate of British pound in a quarter: et+1 = 0+0/NTF+0/NF, et+1 where is the expected percentage change in the exchange rate over the next quarter, INT is the quarterly interest rate differential and INF is the quarterly inflation rate differential. The quarterly data are not available, so you obtained annual data instead and plan to convert them to quarterly data. The most recent annual interest rates are 3.05% in the U.S. and 3.93% in the U.K. The most recent annual inflation rates are 3.67% in the U.S. and 2.15% in the U.K. Today the spot rate is $1.1569. Estimate the exchange rate in a quarter. Round to four decimal places. Example $1.1234

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts