Question: Suppose, you could borrow using either a credit card that charges 1% per month or a bank loan with a 12% quoted nominal interest rate

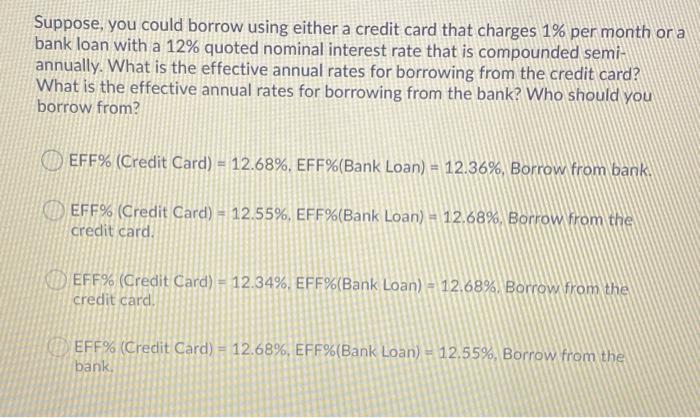

Suppose, you could borrow using either a credit card that charges 1% per month or a bank loan with a 12% quoted nominal interest rate that is compounded semi- annually. What is the effective annual rates for borrowing from the credit card? What is the effective annual rates for borrowing from the bank? Who should you borrow from? EFF% (Credit Card) 12.68%, EFF%(Bank Loan) = 12.36%, Borrow from bank. EFF% (Credit Card) = 12.55%, EFF%(Bank Loan) = 12.68%, Borrow from the credit card. EFF% (Credit Card) - 12.34%. EFF%(Bank Loan) - 12.68% Borrow from the credit card EFF% (Credit Card) = 12.68%, EFF%(Bank Loan) = 12.55%, Borrow from the bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts