Question: Suppose you have been assigned a most important and sensitive task. Where you have to prepare recommendations for the government and SBP which will help

Suppose you have been assigned a most important and sensitive task. Where you have to prepare recommendations for the government and SBP which will help them to manage and stabilize fluctuations and excess devaluations of Rupee. To do this you spend a lot of time in extensive research of the whole economy, use your expertise, and identify key issues having impact on the value of Rupee. (i) By acting on above given information, identify the key factors having impact on the value of rupee and give detailed suggestions of how those identified factors can be improved specifically to reduce fluctuations and relatively stabilize our currency? (Note: You must use actual facts, examples and figures. Avoid general answers). (Marks 08)

Q2 Critically analyze whether monetary policy changes in Pakistan have/had positive or negative impact on macroeconomic factors, institutes and markets in the recent years. Note: In your analysis; firstly, explain the factual reasons behind various monitory changes. Secondly critically analyze impact of each change on macroeconomic factors, financial institutes, businesses and individuals? (Marks 08)

Q3 (a)

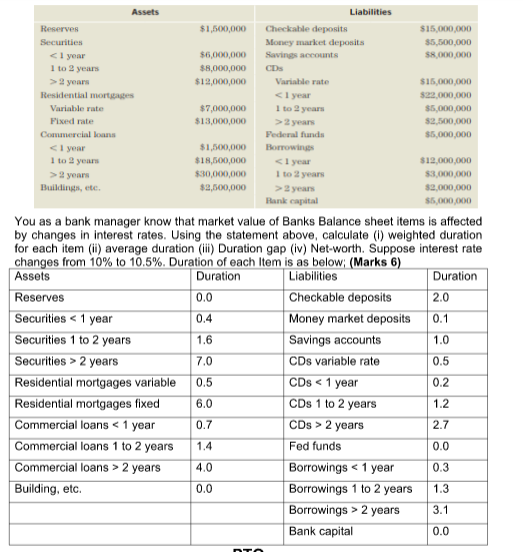

You as a bank manager know that market value of Banks Balance sheet items is affected by changes in interest rates. Using the statement above, calculate (i) weighted duration for each item (ii) average duration (iii) Duration gap (iv) Net-worth. Suppose interest rate changes from 10% to 10.5%. Duration of each Item is as below; (Marks 6)

Q4 (a) Summarize your view as to why banks lending in the greater part of our history has significantly resulted into huge and prolonged loan defaults? (Marks 03)

(b) Assume Central Bank conducts OMO in the following manner; (i) CB purchases 500 million worth bonds from the commercial bank and pays with cheque? (Marks 01) (ii) CB purchases 500 million worth bonds from an individual who deposits check at commercial bank? (Marks 01) (iii) CB purchases 500 million worth bonds from an individual who cashes out cheque from commercial bank? (Marks 01) (iv) CB Sales 500 million worth bonds to an individual who pays with Currency? (Marks 01) (v) CB Sales 500 million worth bonds to an individual who pays with cheque? (Marks 01)

REQUIRED: Interpret the above given data and show the effect on monetary base and money supply in each part?

Assets Liabilities Reserves $1,500,000 Checkable deposits $15,000,000 Securities Money market deposits $6,000,000 $5,500,000 $8.000.000 Savings accounts $8,000,000 CDs 2 years Residential morts $12,000,000 Variable rate $15,000,000 $22,000,000 Variable rate $7,000,000 $5,000,000 2 years Federal funds Fixed rate $13,000,000 $2,500,000 Commercial loans $5,000,000 years $18,500,000 $30,000,000 $2,500,000 2 years Rank capital $5,000,000 You as a bank manager know that market value of Banks Balance sheet items is affected by changes in interest rates. Using the statement above, calculate (1) weighted duration for each item (ii) average duration (1) Duration gap (iv) Net-worth. Suppose interest rate changes from 10% to 10.5%. Duration of each item is as below: (Marks 6) Assets Duration Liabilities Duration 0.0 2.0 0.4 Checkable deposits Money market deposits Savings accounts 0.1 1.6 1.0 7.0 CDs variable rate 0.5 Reserves Securities 2 years Residential mortgages variable Residential mortgages fixed Commercial loans 2 years Fed funds Borrowings 2 years Bank capital Commercial loans > 2 years 4.0 0.3 Building, etc. 0.0 1.3 3.1 0.0 OTO Assets Liabilities Reserves $1,500,000 Checkable deposits $15,000,000 Securities Money market deposits $6,000,000 $5,500,000 $8.000.000 Savings accounts $8,000,000 CDs 2 years Residential morts $12,000,000 Variable rate $15,000,000 $22,000,000 Variable rate $7,000,000 $5,000,000 2 years Federal funds Fixed rate $13,000,000 $2,500,000 Commercial loans $5,000,000 years $18,500,000 $30,000,000 $2,500,000 2 years Rank capital $5,000,000 You as a bank manager know that market value of Banks Balance sheet items is affected by changes in interest rates. Using the statement above, calculate (1) weighted duration for each item (ii) average duration (1) Duration gap (iv) Net-worth. Suppose interest rate changes from 10% to 10.5%. Duration of each item is as below: (Marks 6) Assets Duration Liabilities Duration 0.0 2.0 0.4 Checkable deposits Money market deposits Savings accounts 0.1 1.6 1.0 7.0 CDs variable rate 0.5 Reserves Securities 2 years Residential mortgages variable Residential mortgages fixed Commercial loans 2 years Fed funds Borrowings 2 years Bank capital Commercial loans > 2 years 4.0 0.3 Building, etc. 0.0 1.3 3.1 0.0 OTO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts