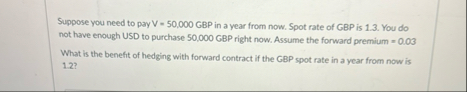

Question: Suppose you need to pay V = 5 0 , 0 0 0 G B P in a year from now. Spot rate of GBP

Suppose you need to pay in a year from now. Spot rate of GBP is You do not have enough USD to purchase right now. Assume the forward premium What is the benefit of hedging with forward contract if the GBP spot rate in a year from now is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock