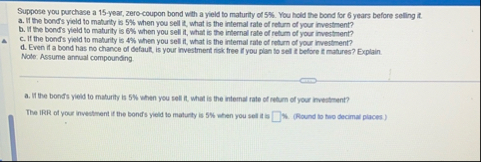

Question: Suppose you purchase a 1 5 year, zero - coupon bond with a yield to maturity of 5 % . You hold the bond for

Suppose you purchase a year, zerocoupon bond with a yield to maturity of You hold the bond for years before selling it

a If the bond's yeid to mahurity is when you sell it what is the internal rate of return of your investment?

b If the bond's yeld to maturity is when you sell it what is the internal rate of return of your investment?

c If the bond's yield to maturity is when you sel if what is the internal rate of return of your investment?

d Even if a bond has no chance of defaut, is your investment nak free if you plan to sell it before it matures? Explain.

Nole: Assume annual compounding.

a It the bonds yeld to maturity is when you sell, what is the internal rate of return of your invertment?

The IRR of your investment if the bond's yield to maturty is when you sell it is Round to twe decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock