Question: You have been provided the following information: Retail Business Cash Accounts receivable Merchandise inventory (BI) Freight-in Merchandise purchases Merchandise inventory (El) Selling expenses $

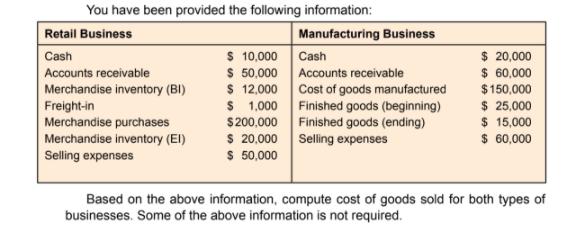

You have been provided the following information: Retail Business Cash Accounts receivable Merchandise inventory (BI) Freight-in Merchandise purchases Merchandise inventory (El) Selling expenses $ 10,000 $ 50,000 $ 12,000 $ 1.000 $200,000 $ 20,000 $ 50,000 Manufacturing Business Cash Accounts receivable Cost of goods manufactured Finished goods (beginning) Finished goods (ending) Selling expenses $ 20,000 $ 60,000 $150,000 $ 25,000 $ 15,000 $ 60,000 Based on the above information, compute cost of goods sold for both types of businesses. Some of the above information is not required.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

A Cost of goods sold for Retail business Merchandise Inventory beginning Add Purchases Ad... View full answer

Get step-by-step solutions from verified subject matter experts