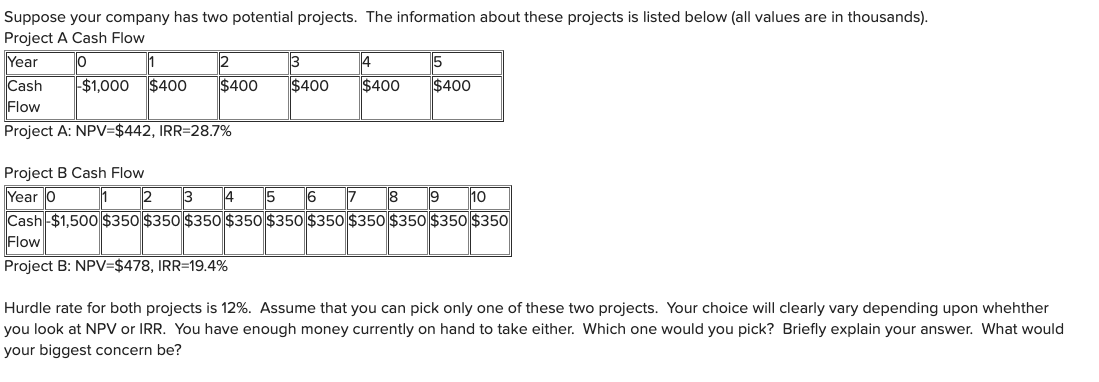

Question: Suppose your company has two potential projects. The information about these projects is listed below (all values are in thousands). Project A Cash Flow Year

Suppose your company has two potential projects. The information about these projects is listed below (all values are in thousands). Project A Cash Flow Year JO 11 2 3 14 15 Cash $1,000 $400 $400 $400 $400 $400 Flow Project A: NPV=$442, IRR=28.7% Project B Cash Flow Year o 2 3 4 5 16 7 8 10 Cash $1,500 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 Flow Project B: NPV=$478, IRR=19.4% Hurdle rate for both projects is 12%. Assume that you can pick only one of these two projects. Your choice will clearly vary depending upon whehther you look at NPV or IRR. You have enough money currently on hand to take either. Which one would you pick? Briefly explain your answer. What would your biggest concern be? Suppose your company has two potential projects. The information about these projects is listed below (all values are in thousands). Project A Cash Flow Year JO 11 2 3 14 15 Cash $1,000 $400 $400 $400 $400 $400 Flow Project A: NPV=$442, IRR=28.7% Project B Cash Flow Year o 2 3 4 5 16 7 8 10 Cash $1,500 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 Flow Project B: NPV=$478, IRR=19.4% Hurdle rate for both projects is 12%. Assume that you can pick only one of these two projects. Your choice will clearly vary depending upon whehther you look at NPV or IRR. You have enough money currently on hand to take either. Which one would you pick? Briefly explain your answer. What would your biggest concern be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts