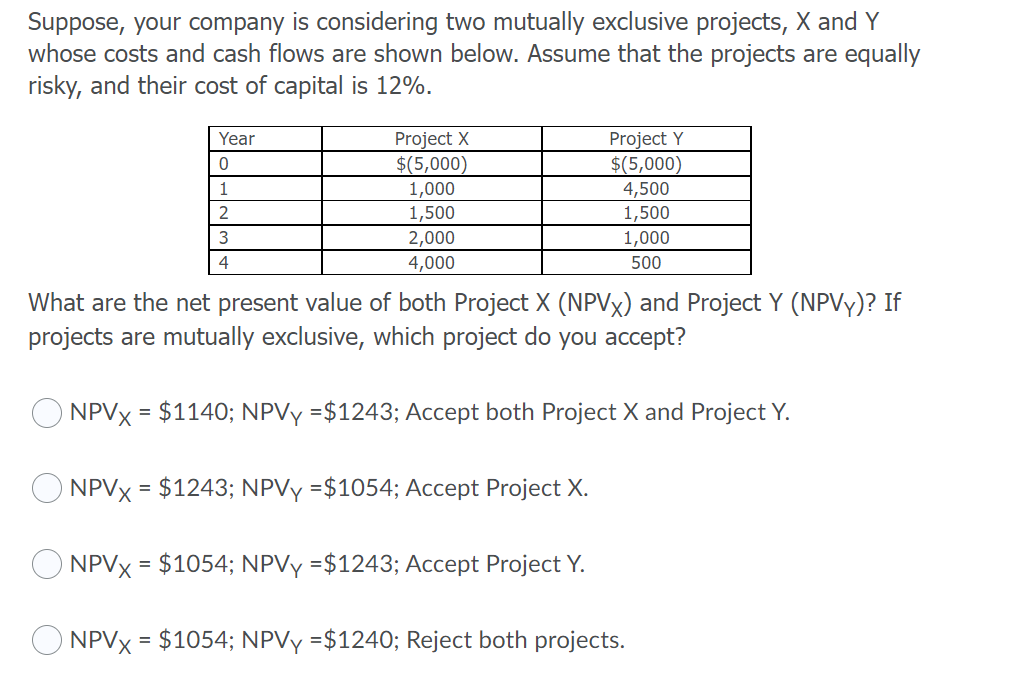

Question: Suppose, your company is considering two mutually exclusive projects, X and Y whose costs and cash flows are shown below. Assume that the projects are

Suppose, your company is considering two mutually exclusive projects, X and Y whose costs and cash flows are shown below. Assume that the projects are equally risky, and their cost of capital is 12%. Year 0 1 2 Project X Project Y $(5,000) $(5,000) 1,000 4,500 1,500 1,500 2,000 1,000 4,000 500 What are the net present value of both Project X (NPVx) and Project Y (NPVY)? If projects are mutually exclusive, which project do you accept? 3 4 O NPVx = $1140; NPVY =$1243; Accept both Project X and Project Y. = O NPVx = $1243; NPVY =$1054; Accept Project X. = NPVx = $1054; NPVy =$1243; Accept Project Y. NPVx = $1054; NPVy =$1240; Reject both projects. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts