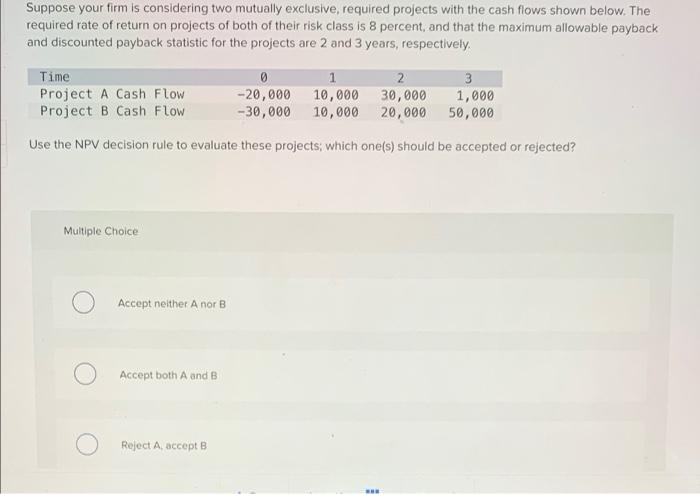

Question: Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both

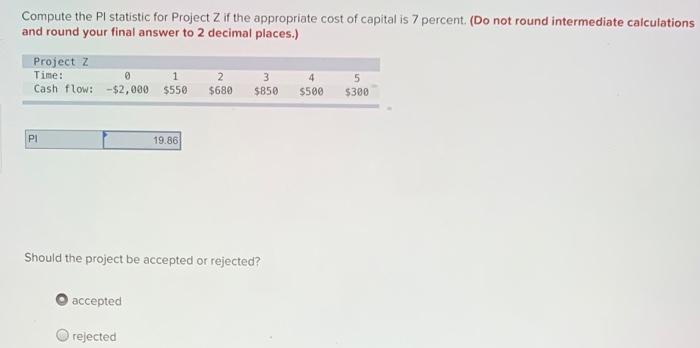

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years, respectively Time Project A Cash Flow Project B Cash Flow 0 1 -20,000 10,000 -30,000 10,000 2 30,000 20,000 3 1,000 50,000 Use the NPV decision rule to evaluate these projects, which one(s) should be accepted or rejected? Multiple Choice Accept neither Anor B Accept both A and B Reject A accept B Compute the Pl statistic for Project Z if the appropriate cost of capital is 7 percent (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project 2 Time: Cash flow: -$2,000 1 $550 2 $680 3 $850 4 $500 5 $300 PI 19.86 Should the project be accepted or rejected? accepted rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts