Question: Suppose your friend is debating purchasing a bond that has a $1,000 par value, 12 years to maturity, and a 6% annual coupon, Your friend

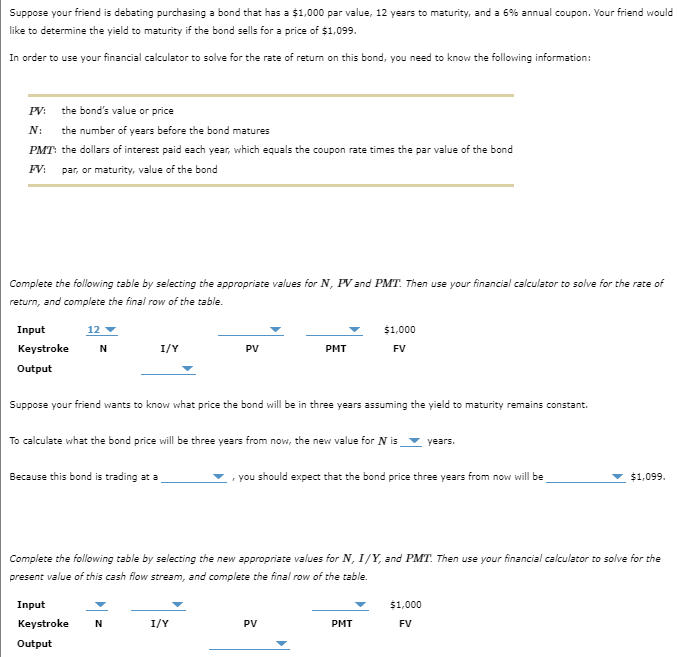

Suppose your friend is debating purchasing a bond that has a $1,000 par value, 12 years to maturity, and a 6% annual coupon, Your friend would like to determine the yield to maturity if the bond sells for a price of $1,099. In order to use your financial calculator to solve for the rate of retum on this bond, you need to know the following information: Complete the following table by selecting the appropriate values for N,PV and PMT. Then use your financial calculator to solve for the rate of return, and complete the final row of the table. Suppose your friend wants to know what price the bond will be in three years assuming the yield to maturity remains constant. To calculate what the bond price will be three years from now, the new value for N is years. Because this bond is trading at a , you should expect that the bond price three years from now will be $1,099. Complete the following table by selecting the new appropriate values for N,I/Y, and PMT. Then use your financial calculator to solve for the present value of this cash flow stream, and complete the final row of the table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts