Question: Surplus lines insurance is most often placed with a surplus lines insurer by Select one: OA. Knowledgeable consumers who approach surplus lines insurers directly. O

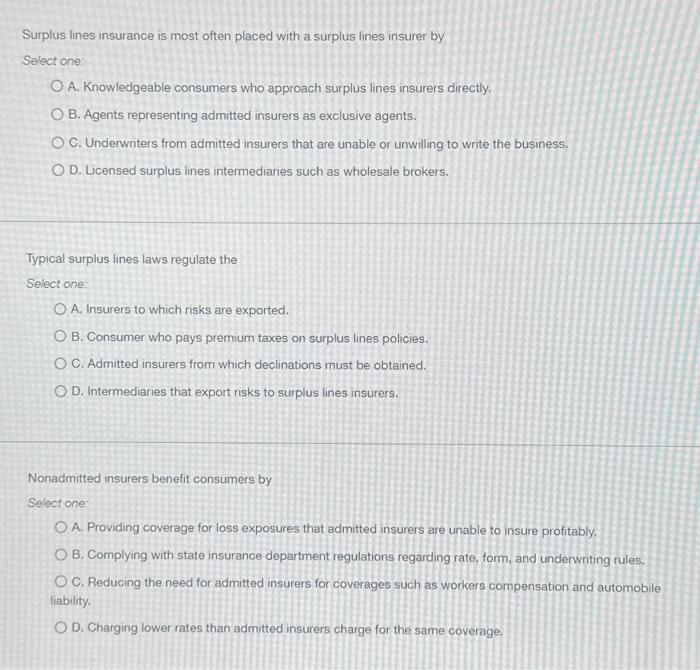

Surplus lines insurance is most often placed with a surplus lines insurer by Select one A. Knowledgeable consumers who approach surplus lines insurers directly. B. Agents representing admitted insurers as exclusive agents. C. Underwriters from admitted insurers that are unable or unwilling to write the business. D. Licensed surplus lines intermediaries such as wholesale brokers. Typical surplus lines laws regulate the Select one: A. Insurers to which risks are exported. B. Consumer who pays premium taxes on surplus lines policies. C. Admitted insurers from which declinations must be obtained. D. Intermediaries that export risks to surplus lines insurers. Nonadmitted insurers benefit consumers by Select one: A. Providing coverage for loss exposures that admitted insurers are unable to insure profitably. B. Complying with state insurance department regulations regarding rate, form, and underwriting rules. C. Reducing the need for admitted insurers for coverages such as workers compensation and automobile liability. D. Charging lower rates than admitted insurers charge for the same coverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts