Question: *Suspense accounts are opened either to correct errors or when it is not known immediately where to post an amount. A suspense account is temporary

*Suspense accounts are opened either to correct errors or when it is not known immediately where to post an amount. A suspense account is temporary and will be closed once it has become clear which account should be correctly posted by the given amount.

*Suspense accounts are opened either to correct errors or when it is not known immediately where to post an amount. A suspense account is temporary and will be closed once it has become clear which account should be correctly posted by the given amount.

The following additional information is relevant:

a) Inventory as at 31 December 2018 was valued at 1,600,000.

b) Depreciation has to be provided as follows:

i. Buildings at 5% straight-line, charged to administrative expenses

ii. Plant and equipment at 20% on the reducing balance basis, charged to cost of sales

iii. Motor vehicles at 25% on the reducing balance basis, charged to cost of distribution costs

c) A customer has gone bankrupt owing 76,000. This debt is not expected to be received and has to be written off. In addition, it has been decided to set up a provision for doubtful debts of 5% of the receivables at the year-end

d) 1 million new ordinary shares were issued at 1.50 per share on 1st December 2018. On that date the proceeds were debited to the cash and bank account and credited to the suspense account.

e) Land was revalued as at 31 December 2018 at 1,000,000

Required:

1. Prepare the following:

a. Statement of profit or loss and the statement comprehensive income for the year ended 31st December 2018 (you may choose to prepare two separate statements or one statement that combines the two).

b. Statement of changes in equity for the year ended 31st December 2018

c. Statement of financial position as at 31st December 2018

Provide all the financial statements with proper headings

Show all workings, ignore taxation

****

2. Explain which accounting concept justifies setting up provision for doubtful debts - see (C) above.

***

3. Explain why Willow Ltd. might have chosen to revalue their land rather than continuing to show it at cost. Why should they carry out subsequent revaluations on a regular basis ( at least at the end of each financial year ) from now on?

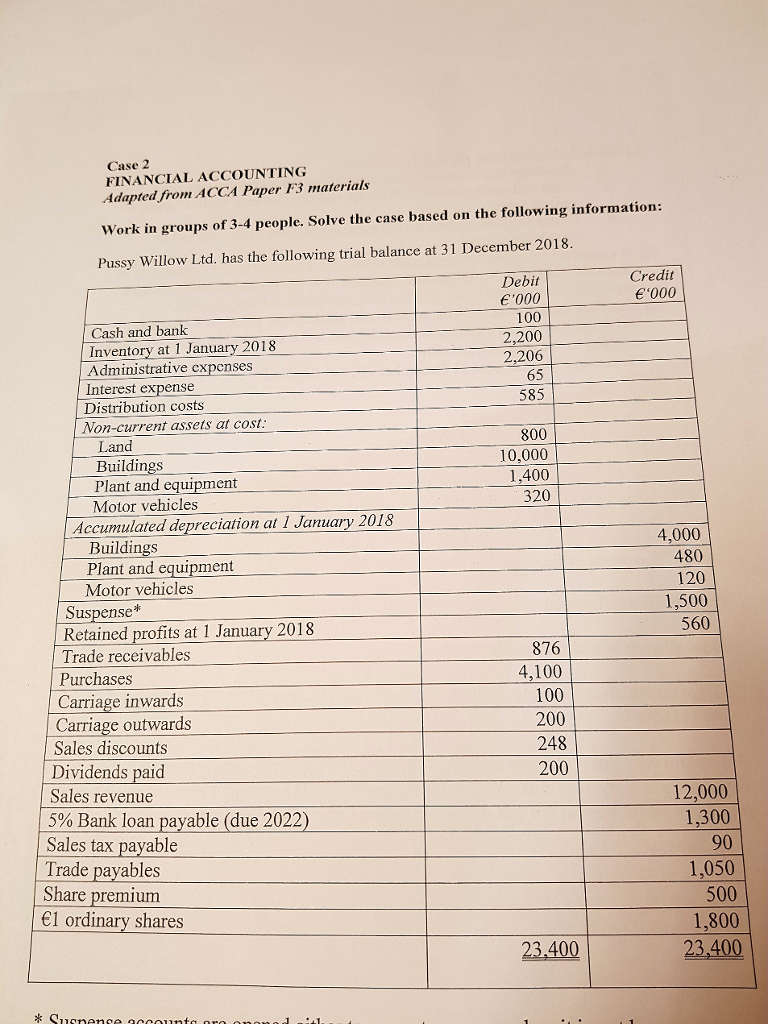

Case 2 FINANCIAL ACCOUNTING Adapted from ACCA Paper I3 materials Work in groups of 3-4 people. Solve the case based on the following information: Pussy Willow Ltd. has the following trial balance at 31 December 2018. Debit Credit Cash and bank Inventory at 1 January 2018 Administrative cxpenses Interest expense Distribution costs Non-current assets at cost 100 2,200 2,206 65 585 Land Buildings 800 10,000 1,400 320 Plant and equipment Motor vehicles Accumlated depreciation at 1 January 2018 Buildings 4,000 480 120 1,500 560 Plant and equipment Motor vehicles Suspense* Retained profits at 1 January 2018 Trade receivables Purchases Carriage inwards Carriage outwards Sales discounts 876 4,100 100 200 248 200 Dividends paid Sales revenue 12,000 1,300 90 1,050 500 1,800 23,400 5% Bank loan payable (due 2022) ales tax payable Trade payables Share premium 1 ordinary shares 23,400 Case 2 FINANCIAL ACCOUNTING Adapted from ACCA Paper I3 materials Work in groups of 3-4 people. Solve the case based on the following information: Pussy Willow Ltd. has the following trial balance at 31 December 2018. Debit Credit Cash and bank Inventory at 1 January 2018 Administrative cxpenses Interest expense Distribution costs Non-current assets at cost 100 2,200 2,206 65 585 Land Buildings 800 10,000 1,400 320 Plant and equipment Motor vehicles Accumlated depreciation at 1 January 2018 Buildings 4,000 480 120 1,500 560 Plant and equipment Motor vehicles Suspense* Retained profits at 1 January 2018 Trade receivables Purchases Carriage inwards Carriage outwards Sales discounts 876 4,100 100 200 248 200 Dividends paid Sales revenue 12,000 1,300 90 1,050 500 1,800 23,400 5% Bank loan payable (due 2022) ales tax payable Trade payables Share premium 1 ordinary shares 23,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts