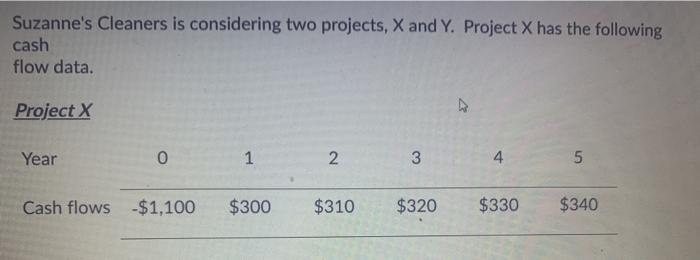

Question: Suzanne's Cleaners is considering two projects, X and Y. Project X has the following cash flow data. Project X Year 0 1 2 3 4.

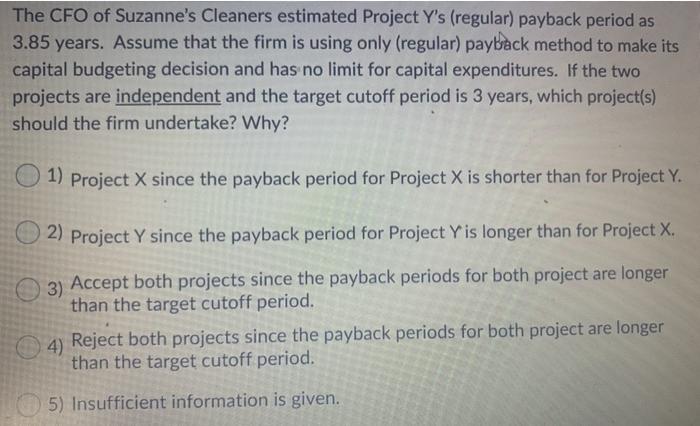

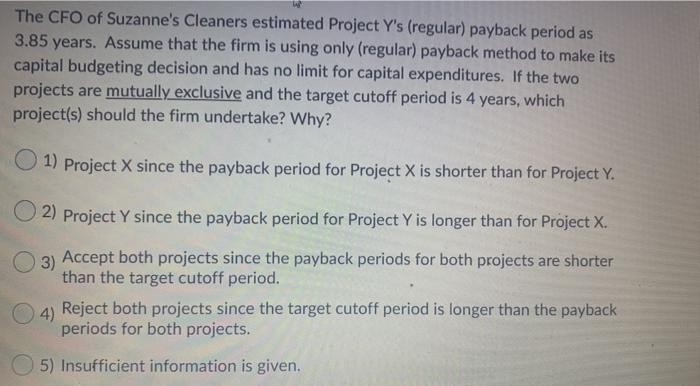

Suzanne's Cleaners is considering two projects, X and Y. Project X has the following cash flow data. Project X Year 0 1 2 3 4. 5 Cash flows -$1,100 $300 $310 $320 $330 $340 The CFO of Suzanne's Cleaners estimated Project Y's (regular) payback period as 3.85 years. Assume that the firm is using only (regular) payback method to make its capital budgeting decision and has no limit for capital expenditures. If the two projects are independent and the target cutoff period is 3 years, which project(s) should the firm undertake? Why? 1) Project X since the payback period for Project X is shorter than for Project Y. 2) Project Y since the payback period for Project Yis longer than for Project X. 3) Accept both projects since the payback periods for both project are longer than the target cutoff period. 4) Reject both projects since the payback periods for both project are longer than the target cutoff period. 5) Insufficient information is given. The CFO of Suzanne's Cleaners estimated Project Y's (regular) payback period as 3.85 years. Assume that the firm is using only (regular) payback method to make its capital budgeting decision and has no limit for capital expenditures. If the two projects are mutually exclusive and the target cutoff period is 4 years, which project(s) should the firm undertake? Why? 1) Project X since the payback period for Project X is shorter than for Project Y. O2) Project Y since the payback period for Project Y is longer than for Project X. 3) Accept both projects since the payback periods for both projects are shorter than the target cutoff period. 4) Reject both projects since the target cutoff period is longer than the payback periods for both projects. 5) Insufficient information is given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts