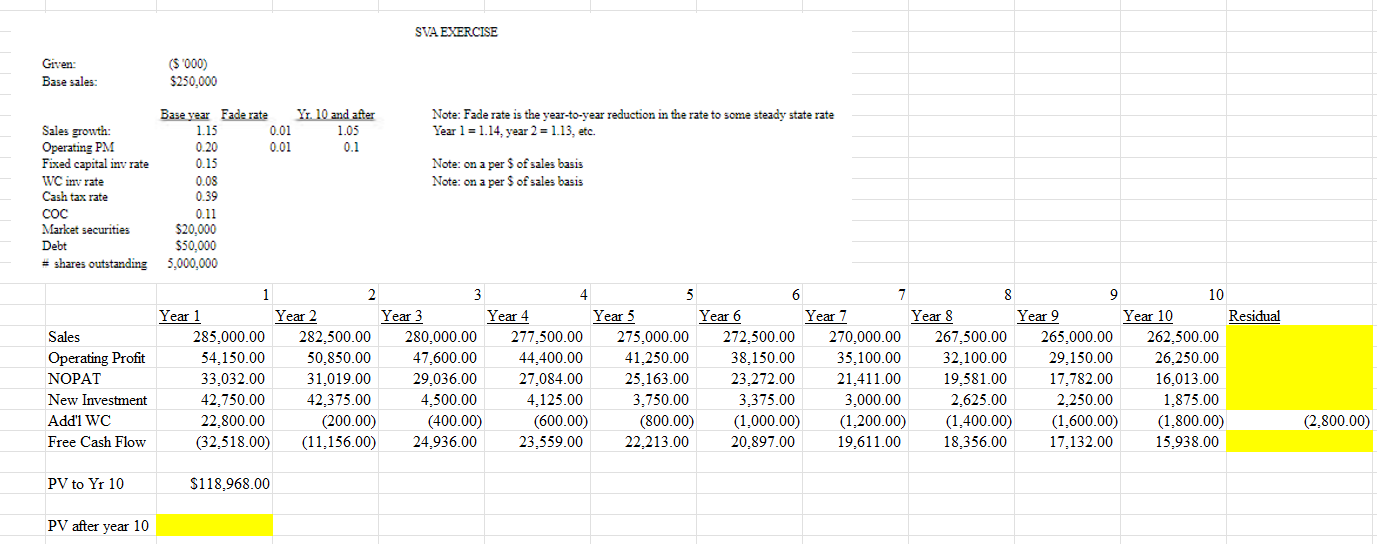

Question: SVA EXERCISE Given: ($ '000) Base sales: $250,000 Base year Fade rate Yr. 10 and after Note: Fade rate is the year-to-year reduction in the

SVA EXERCISE Given: ($ '000) Base sales: $250,000 Base year Fade rate Yr. 10 and after Note: Fade rate is the year-to-year reduction in the rate to some steady state rate Sales growth: 1.15 0.01 1.05 Year 1 = 1.14, year 2 = 1.13, etc. Operating PM 0.20 0.01 0.1 Fixed capital inv rate 0.15 Note: on a per $ of sales basis WC inv rate 0.08 Note: on a per $ of sales basis Cash tax rate 0.39 COC 0.11 Market securities $20,000 Debt $50,000 # shares outstanding 5,000,000 1 2 3 4 5 6 7 8 9 10 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Residual Sales 285,000.00 282,500.00 280,000.00 277,500.00 275,000.00 272,500.00 270,000.00 267,500.00 265,000.00 262,500.00 Operating Profit 54,150.00 50,850.00 47,600.00 44,400.00 41,250.00 38,150.00 35,100.00 32,100.00 29,150.00 26,250.00 NOPAT 33,032.00 31,019.00 29,036.00 27,084.00 25,163.00 23,272.00 21,411.00 19,581.00 17,782.00 16,013.00 New Investment 42,750.00 42,375.00 4,500.00 4,125.00 3,750.00 3,375.00 3,000.00 2,625.00 2,250.00 1,875.00 Add'1 WC 22,800.00 (200.00) (400.00) (600.00) (800.00) (1,000.00) (1,200.00) (1,400.00) (1,600.00) (1,800.00) (2,800.00) Free Cash Flow (32,518.00) (11,156.00) 24,936.00 23,559.00 22,213.00 20,897.00 19,611.00 18,356.00 17,132.00 15,938.00 PV to Yr 10 $118,968.00 PV after year 10