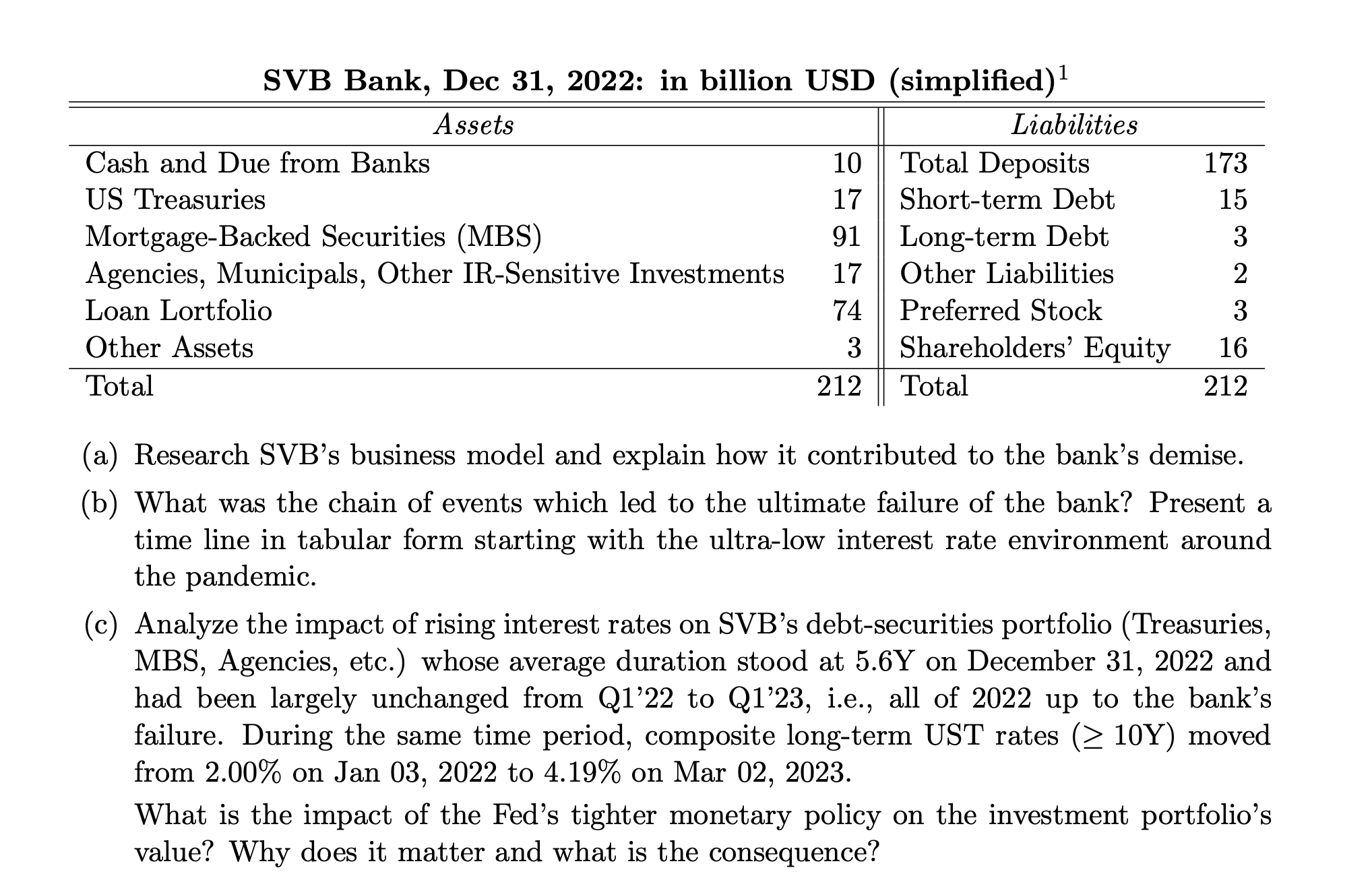

Question: SVB Bank, Dec 3 1 , 2 0 2 2 : in billion USD ( simplified ) ( { } ^ { 1 }

SVB Bank, Dec : in billion USD simplifieda Research SVBs business model and explain how it contributed to the bank's demise. b What was the chain of events which led to the ultimate failure of the bank? Present a time line in tabular form starting with the ultralow interest rate environment around the pandemic. c Analyze the impact of rising interest rates on SVBs debtsecurities portfolio Treasuries MBS Agencies, etc. whose average duration stood at Y on December and had been largely unchanged from Q to Q ie all of up to the bank's failure. During the same time period, composite longterm UST rates geq mathrmY moved from on Jan to on Mar What is the impact of the Fed's tighter monetary policy on the investment portfolio's value? Why does it matter and what is the consequence?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock