Question: Swaps Suppose notional principal ( NP ) = $ 1 0 0 million. An investor enters a 2 - year OIS paying a fixed rate

Swaps

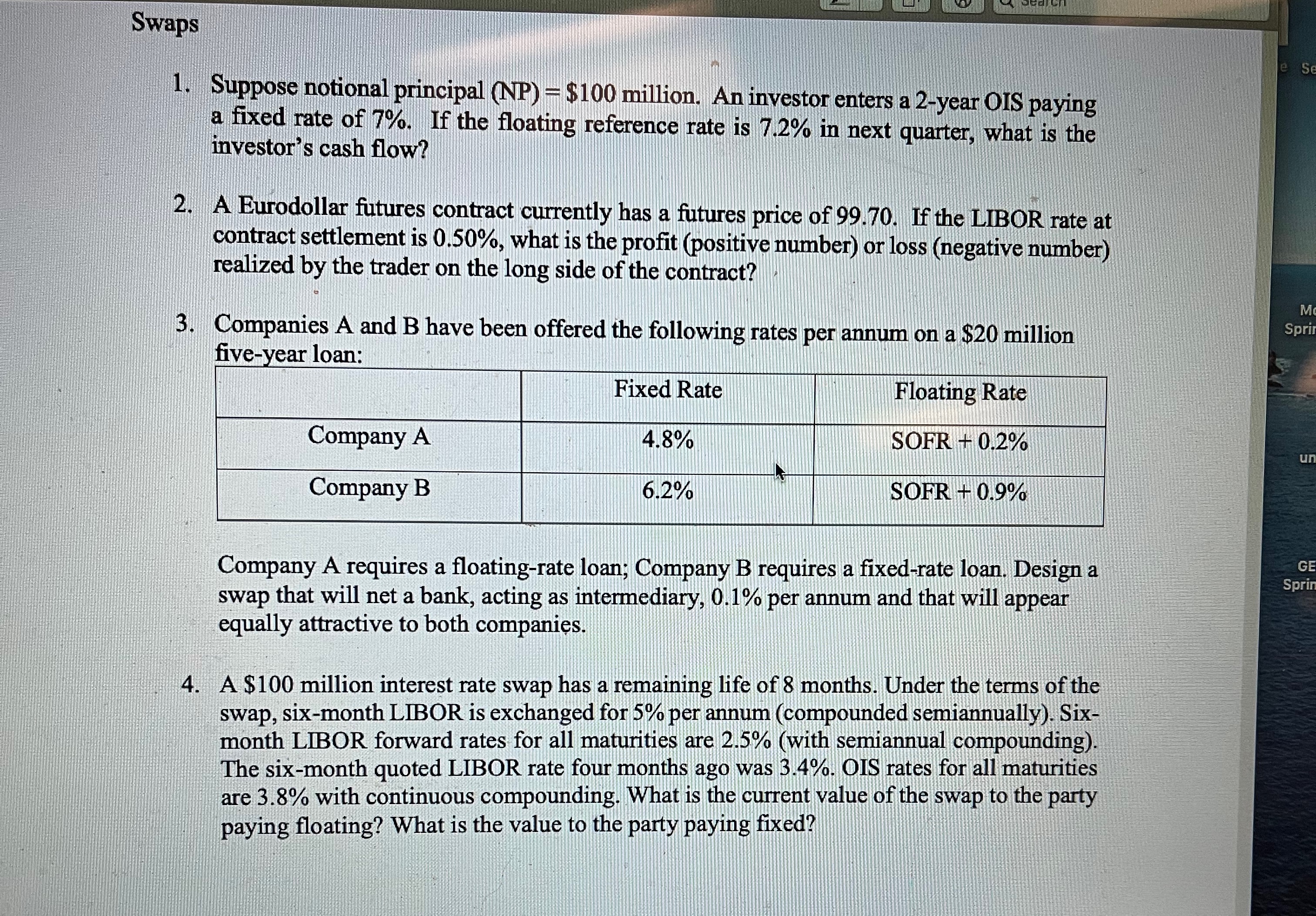

Suppose notional principal NP$ million. An investor enters a year OIS paying a fixed rate of If the floating reference rate is in next quarter, what is the investor's cash flow?

A Eurodollar futures contract currently has a futures price of If the LIBOR rate at contract settlement is what is the profit positive number or loss negative number realized by the trader on the long side of the contract?

Companies A and have been offered the following rates per annum on a $ million fiveyear loan:

tableFixed Rate,Floating RateCompany ASOFR Company BSOFR

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock