Question: swarch the course Activity Video Chapter 3 Preparing an individual's tax form Adam Burke graduated from college in 2 0 2 3 and began work

swarch the course

Activity

Video

Chapter

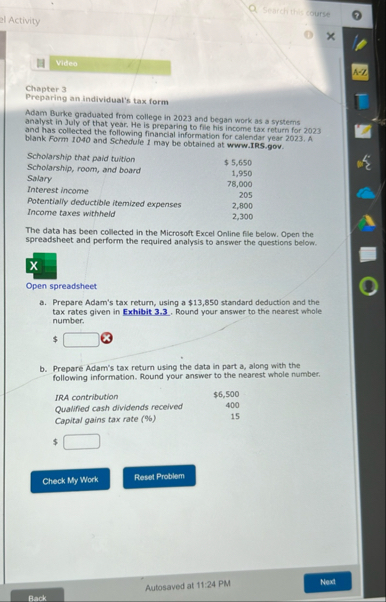

Preparing an individual's tax form

Adam Burke graduated from college in and began work as a systems analyst in July of that year. He is preparing to file his income tax return for and has collected the following financial information for calendar year A blank Form and Schedule may be obtained at

wwwIRS.gov.

Scholarship that paid tuition

Scholarship, room, and board

Salary

Interest income

$

Potentially deductible itemized expenses

Income taxes withheld

A

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

Open spreadsheet

a Prepare Adam's tax return, using a $ standard deduction and the tax rates given in Exhibit Round your answer to the nearest whole number.

$

b Prepare Adam's tax return using the data in part a along with the following information. Round your answer to the nearest whole number.

IRA contribution

$

Qualified cash dividends received

Capital gains tax rate

$

Autosaved at : PM

Pack

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock