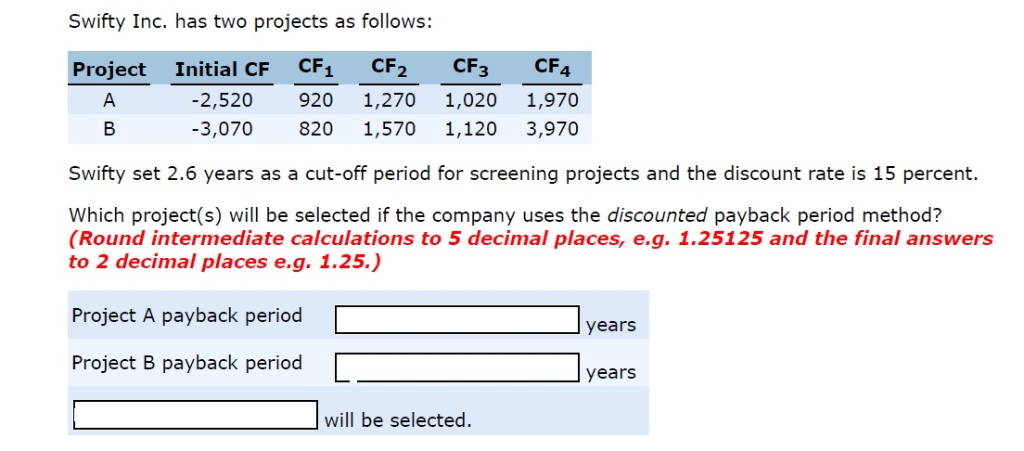

Question: Swifty Inc. has two projects as follows: Project A Initial CF CF -2,520 920 -3,070 820 CF2 1,270 1,570 CF3CF4 1,020 1,970 1,120 3,970 B

Swifty Inc. has two projects as follows: Project A Initial CF CF -2,520 920 -3,070 820 CF2 1,270 1,570 CF3CF4 1,020 1,970 1,120 3,970 B Swifty set 2.6 years as a cut-off period for screening projects and the discount rate is 15 percent. Which project(s) will be selected if the company uses the discounted payback period method? (Round intermediate calculations to 5 decimal places, e.g. 1.25125 and the final answers to 2 decimal places e.g. 1.25.) Project A payback period years Project B payback period years will be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts