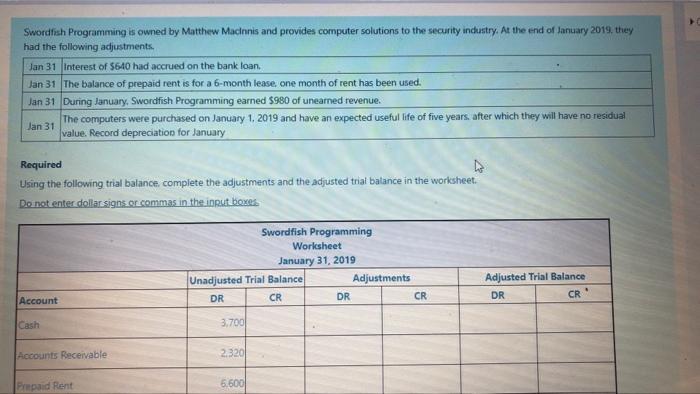

Question: Swordfish Programming is owned by Matthew Macinnis and provides computer solutions to the security industry. At the end of January 2019. they had the following

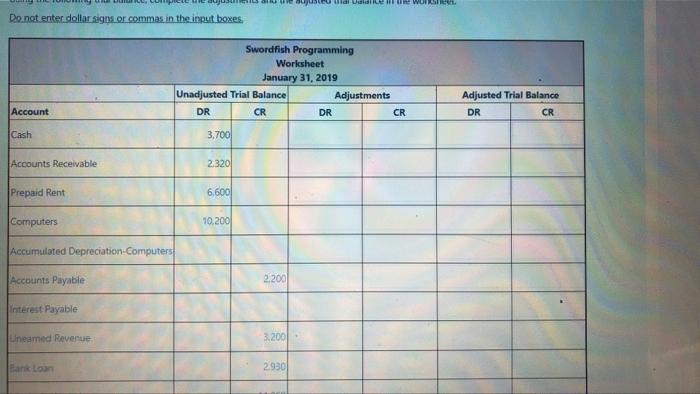

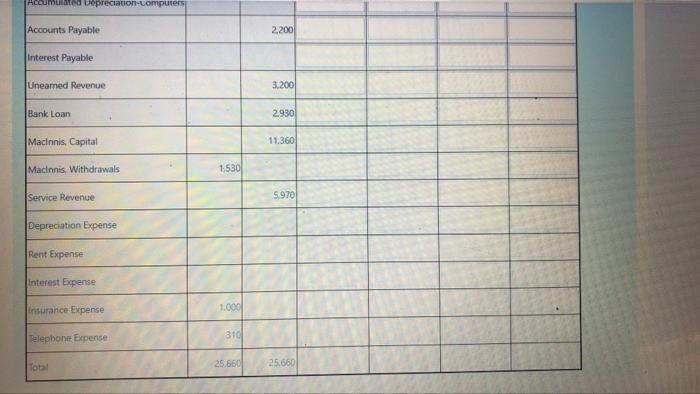

Swordfish Programming is owned by Matthew Macinnis and provides computer solutions to the security industry. At the end of January 2019. they had the following adjustments, Jan 31 Interest of $640 had accrued on the bank loan. Jan 31 The balance of prepaid rent is for a 6-month lease, one month of rent has been used. Jan 31 During January, Swordfish Programming earned $980 of unearned revenue. Jan 31 The computers were purchased on January 1, 2019 and have an expected useful life of five years after which they will have no residual value. Record depreciation for January Required Using the following trial balance, complete the adjustments and the adjusted trial balance in the worksheet. Do not enter dollar signs or commas in the input boxes Swordfish Programming Worksheet January 31, 2019 Unadjusted Trial Balance Adjustments CR DR CR Adjusted Trial Balance DR DR Account CR Cash 3.700 Accounts Receivable 2.320 Prepaid Rent 6600 THE WAR. Do not enter dollar signs or commas in the input boxes Swordfish Programming Worksheet January 31, 2019 Unadjusted Trial Balance Adjustments DR CR DR CR Adjusted Trial Balance DR CR Account Cash 3,700 Accounts Receivable 2.320 Prepaid Rent 6.600 Computers 10.200 Accumulated Depreciation Computers Accounts Payable 2.200 Interest Payable Uneamed Revenue 3.2001 Bank Loan 2930 te wepreciation computers Accounts Payable 2.2001 Interest Payable Uneamed Revenue 3.200 Bank Loan 2.930 Macinnis, Capital 11.360 Macinnis, Withdrawals 1530 Service Revenue 5.970 Depreciation Expense Rent Expense Interest Expense Insurance Expense 1.000 310 Telephone Expense Total 25,660 25.660

Step by Step Solution

There are 3 Steps involved in it

Lets carefully analyze the information and complete the worksheet Step 1 Extract Unadjusted Trial Ba... View full answer

Get step-by-step solutions from verified subject matter experts