Question: Swot Analysis and Porter's Five Force Model Analysis The HP-Compaq Merger Story BSTR027 A SETBACK On September 4, 2001, leading global computer industry players Hewlett-Packard

Swot Analysis and Porter's Five Force Model Analysis

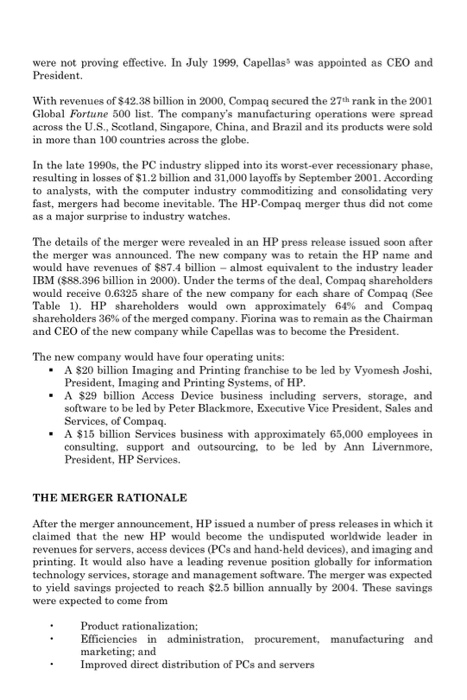

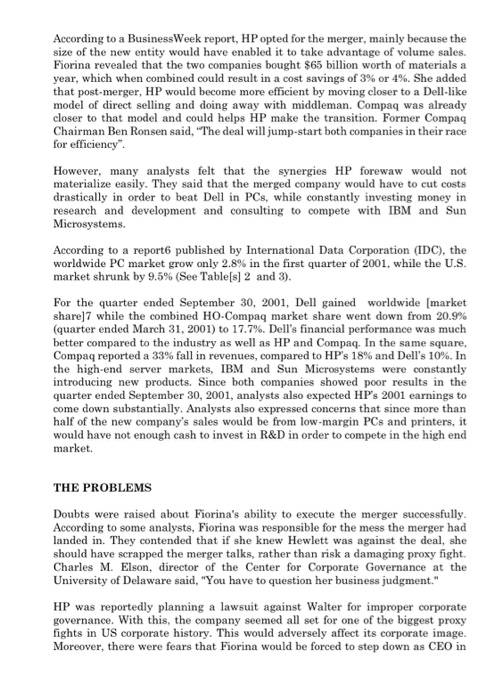

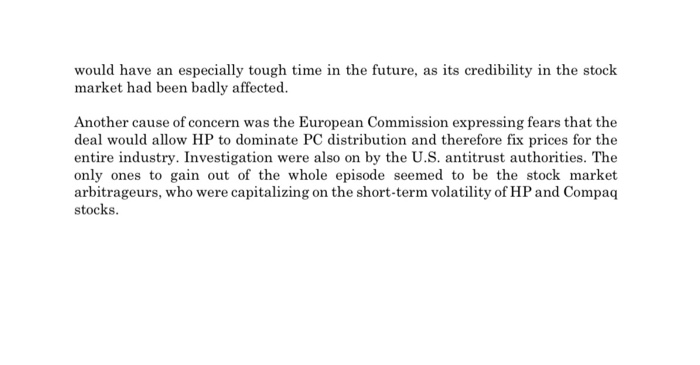

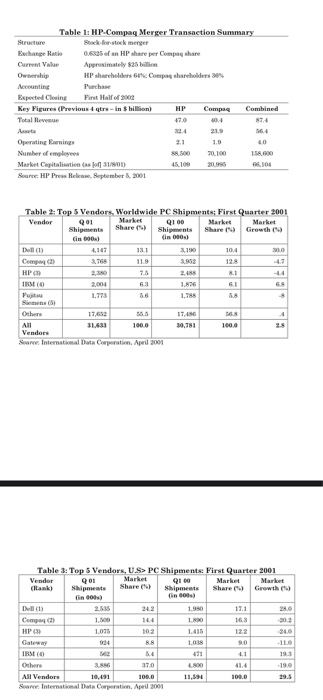

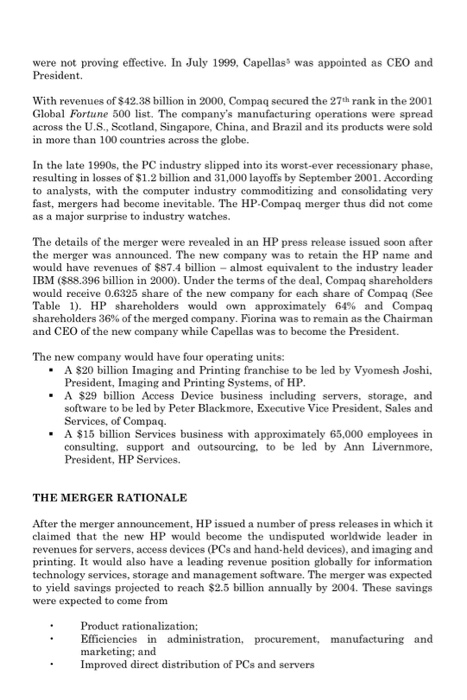

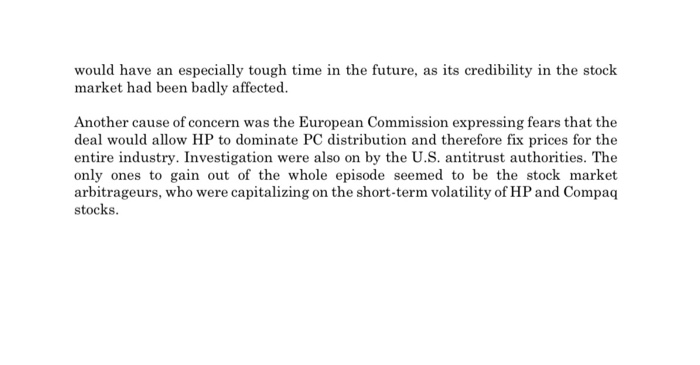

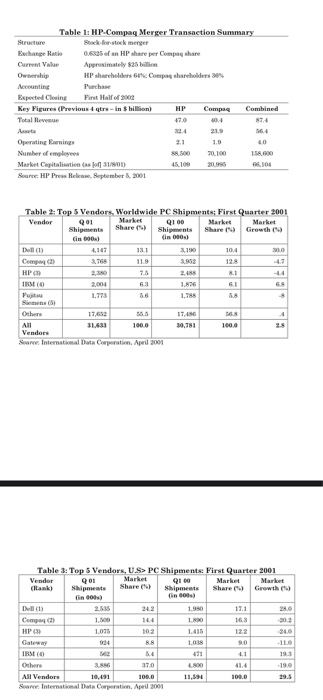

The HP-Compaq Merger Story BSTR027 A SETBACK On September 4, 2001, leading global computer industry players Hewlett-Packard Company (HP) and Compaq Computer Corporation (Compaq) announced their merger. HP was to buy Compaq for $25 billion in stock in the biggest ever deal in the history of the computer industry. The merged entity was to have operations in more than 160 countries with over 145,000 employees, offering the industry's most complete set of products and services. Surprisingly, the stock markets reacted negatively to the announcement with shares of both companies collapsing - in just two days, HP and Compaq share prices declined by 21.5% and 15.7% respectively. Together the pair lost $13 billion in market capitalization. In spite of this, HP's Chairman and CEO, Carly Fiorina (Fiorina) was confident about the merger. In an interview2 she said, "This is a very tight agreement. You don't make this kind of move and judge its success by the short-term stock price." However, in the next two weeks, HP's stock went down by another 17%, amidst a lot of negative publicity. HP's competitors felt that the proposed merger would not work for the company and the combined entity would lose market share. Sun Microsystems President Edward J. Zander said, "When two sick companies combine, I'm not sure what you get. This is a great opportunity for us, IBM, and others to go after market share." Dell CEO Michael S. Dell added that the merger would only confuse customers and benefit HP's competitors. On November 6, 2001, the merger faced another hurdle in the form of Walter B. Hewlett (Walter), the eldest son of Hewlett-Packard co-founder William R. Hewlett. Though Walter had initially approved the bid, he decided to use his 5.2% stake to oppose the merger. Soon, another relative of HP's founders, David Woodley Packard (David) and The David and Lucile Packard Foundation, HP's largest shareholder, with a 10.4% stake, also decided to oppose the merger. By January 2002, with so much going against the merger, industry observers seemed to have written it off. even though the shareholder meeting for the proposal's approval was yet to be held. BACKGROUND NOTE Hewlett-Packard Stanford engineers Bill Hewlett and David Packard started HP in California in 1938 as an electronic instruments company. Its first product was a resistance- capacity audio oscillator, an electronic instrument used to test sound equipment. During the 1940s, HP's products rapidly gained acceptance among engineers and scientists. HP's growth was aided by heavy purchases made by the US government during the Second World War. During the 1950s, HP developed strong technological capabilities in the rapidly evolving electronies business. In 1951, HP invented the high speed frequency counter, which significantly reduced the time required to measure high frequencies. HP came out with its first public issue in 1957. HP entered the medical field in 1961 by purchasing Sanborn Company. In 1963, HP entered into a joint venture agreement with Yokogawa Electric Works of Japan to form Yokogawa-Hewlett-Packard. In 1966, the company established HP Laboratories, to conduct research activities relating to new technologies and products. During the same year, HP designed its first computer for controlling some of its test-and-measurement instruments. During the 1970s, HP continued its tradition of innovation. In 1974, HP launched its first minicomputer that was based on 4K dynamic random access semiconductors (DRAM's) instead of magnetic cores. In 1977, John Young was named HP president, marking a transition from the era of the founders to a new generation of professional managers. During the 1980s, HP emerged as a major player in the computer industry, offering a full range of computers from desktop machines to powerful minicomputers. This decade also saw the development of successful products like the Inkjet and LaserJet printers. HP introduced its first personal computer (PC) in 1981, followed by an electronic mail system in 1982. This was the first major wide-area commercial network that was based on a minicomputer. HP also introduced its HP 9000 computer with a 32-bit superchip. HP became a leader in workstations with the 1989 purchase of market leader, Apollo Computers. In 1992, HP acquired Texas Instruments' line of UNIX-based computers. HP reinforced its cost cutting efforts and reduced the prices of its PC printer, UNIX workstations, and customer support operations in 1995 into an integrated computer division. In 1997, HP acquired electronic transactions company Verifone3 for nearly $1.2 billion, to strengthen its capabilities in Internet commerce. HP's capabilities in Internet security and Verifone's expertise in handling financial transactions were expected to complement each other. During 1997, lower demand caused a drop in growth to below 20% for the first time in five years, and HP responded by recognizing printer and other operations. In the first quarter of 1999, HP spun off its test-and measurement equipment division, into a new $8 billion business Analyst felt that the (spin)- off reflected the increasingly (cutthroat] competition in the computer industry. They also felt that HP needed a new leadership to cope with rapidly evolving industry trends. According to an HP employee, "What you are seeing is an end of a class of management. If you look at all the top management, they are all of the same age, they lived through a certain era of HP. We need to refresh the leadership, there will be more youthfulness and spontaneity with the changes". In view of these concerns, the HP board appointed Fiorina4 as the CEO in July 1999. By 2001, with net revue of $48.78 billion, HP ranked 19th in the global Fortune 500 list. The company has emerged as the second largest computer manufacturer in the world, and was the market leader in desktop computers, servers, peripherals and services such as systems integration. Besides computer related products and services, which accounted for more than 80% of sales, the company also made electronic products and systems for measurement computing and communications. Compaq Compaq was founded by Joseph R. Canion along with some of his erstwhile Texas Instruments colleagues in February 1982. The seed capital of $1.5 million was arranged by venture capitalist Benjamin Risen, who became the founder chairman. Compaq initially manufactured and sold IBM compatible computers. The name Compaq was derived from compatibility and quality. Within a year of incorporation, Compaq registered sales of $111 million. In December 1983, the company made an Initial Public Offer (IPO) of six million shares at $11 per share. Compaq soon came to be seen as a major alternatives to IBM for the supply of personal computers Over the years, Compaq had developed into a full range computer company catering to various segments. Compaq offered three broad categories of products: The Enterprise Computing Group. The group provided both products and services. Products included main frames, servers, workstations, fault tolerant business critical solutions, enterprise options and solutions, Internet products and networking products. Compaq provided services fulfilling a wide variety of information technology infrastructure business requirements, both directly and in alliance with third party service providers. Compaq's service offerings included business critical services for multi-vendor software and hardware products. Professional services included information systems consulting, technical and application design services; system integration and project management services; network design, integration and support services; and outsourcing and resource management services The Commercial PC Group - The group dealt with products like commercial desktops, portables, [and] small and medium business solutions. PCs products accounted for approximately 30 percent of Compaq's worldwide revenues. The Consumer PC Group - Products like desktops, mini tower computers, portables, (and) printers (.....) were included in this category. They accounted for approximately 16 percent of Compaq's worldwide revenues. In 1998, Compaq acquired Digital Equipment Corporation (DEC) for $9.1 billion in an attempt to become a "full services" computer company. However, the integration with DEC did not goes smoothly as planned. Analyst felt that the company's effort to imitate competitor Dell Computer's (Dell) direct sales strategy were not proving effective. In July 1999, Capellas was appointed as CEO and President With revenues of $42.38 billion in 2000, Compaq secured the 27th rank in the 2001 Global Fortune 500 list. The company's manufacturing operations were spread across the U.S., Scotland, Singapore, China, and Brazil and its products were sold in more than 100 countries across the globe. In the late 1990s, the PC industry slipped into its worst-ever recessionary phase, resulting in losses of $1.2 billion and 31,000 layoffs by September 2001. According to analysts, with the computer industry commoditizing and consolidating very fast, mergers had become inevitable. The HP Compaq merger thus did not come as a major surprise to industry watches. The details of the merger were revealed in an HP press release issued soon after the merger was announced. The new company was to retain the HP name and would have revenues of $87.4 billion - almost equivalent to the industry leader IBM ($88.396 billion in 2000). Under the terms of the deal, Compaq shareholders would receive 0.6325 share of the new company for each share of Compaq (See Table 1). HP shareholders would own approximately 64% and Compaq shareholders 36% of the merged company. Fiorina was to remain as the Chairman and CEO of the new company while Capellas was to become the President. The new company would have four operating units: A $20 billion Imaging and Printing franchise to be led by Vyomesh Joshi, President, Imaging and Printing Systems, of HP. . A $29 billion Access Device business including servers, storage, and software to be led by Peter Blackmore, Executive Vice President, Sales and Services, of Compaq. A $15 billion Services business with approximately 65,000 employees in consulting, support and outsourcing, to be led by Ann Livernmore, President, HP Services. THE MERGER RATIONALE After the merger announcement, HP issued a number of press releases in which it claimed that the new HP would become the undisputed worldwide leader in revenues for servers, access devices (PCs and hand-held devices), and imaging and printing. It would also have a leading revenue position globally for information technology services, storage and management software. The merger was expected to yield savings projected to reach $2.5 billion annually by 2004. These savings were expected to come from Product rationalization; Efficiencies in administration, procurement, manufacturing and marketing, and Improved direct distribution of PCs and servers According to a BusinessWeek report, HP opted for the merger, mainly because the size of the new entity would have enabled it to take advantage of volume sales. Fiorina revealed that the two companies bought $65 billion worth of materials a year, which when combined could result in a cost savings of 3% or 4%. She added that post-merger, HP would become more efficient by moving closer to a Dell-like model of direct selling and doing away with middleman. Compaq was already closer to that model and could helps HP make the transition. Former Compaq Chairman Ben Ronsen said, "The deal will jump-start both companies in their race for efficiency". However, many analysts felt that the synergies HP forewaw would not materialize easily. They said that the merged company would have to cut costs drastically in order to beat Dell in PCs, while constantly investing money in research and development and consulting to compete with IBM and Sun Microsystems. According to a report published by International Data Corporation (IDC), the worldwide PC market grow only 2.8% in the first quarter of 2001, while the U.S. market shrunk by 9.5% (See Table[s] 2 and 3). For the quarter ended September 30, 2001, Dell gained worldwide (market share]7 while the combined HO-Compaq market share went down from 20.9% (quarter ended March 31, 2001) to 17.7%. Dell's financial performance was much better compared to the industry as well as HP and Compaq. In the same square, Compaq reported a 33% fall in revenues, compared to HP's 18% and Dell's 10%. In the high-end server markets, IBM and Sun Microsystems were constantly introducing new products. Since both companies showed poor results in the quarter ended September 30, 2001, analysts also expected HP's 2001 earnings to come down substantially. Analysts also expressed concerns that since more than half of the new company's sales would be from low-margin PCs and printers, it would have not enough cash to invest in R&D in order to compete in the high end market. THE PROBLEMS Doubts were raised about Fiorina's ability to execute the merger successfully According to some analysts, Fiorina was responsible for the mess the merger had landed in. They contended that if she knew Hewlett was against the deal, she should have scrapped the merger talks, rather than risk a damaging proxy fight. Charles M. Elson, director of the Center for Corporate Governance at the University of Delaware said, "You have to question her business judgment." HP was reportedly planning a lawsuit against Walter for improper corporate governance. With this, the company seemed all set for one of the biggest proxy fights in US corporate history. This would adversely affect its corporate image. Moreover, there were fears that Fiorina would be forced to step down as CEO in case the merger did not materialize. Analysts claimed that Fiorina's exit could worsen HP's financial position as the new CEO would have to figure out new strategies for the company. Meanwhile, with the Hewlett and Packard Foundation opposing the merger, HP employees began to lose faith in Fiorina's management. According to a Business Week report, Hp surveys done before November 6, 2001, showed that 84% of the employees supported the acquisition - this fell to 55% after Walter's opposition. HP Vice-President for Human Resources Susan Bowick admitted "Morale statistics are lower than we've ever seen them. Employees were really with us until Walter did what he did, but he opened up a flurry of doubt." The report also hinted that there was growing employee resentment over the steps taken by Fiorina to control costs. Some of the cost-cutting measures, including the forced five day vacation for the workers in December 2000, the postponement of wage hikes for three months and the January 2001 [layoff] of 1,700 employees, were strongly opposed. Things worsened when the HP management announce that it would lay off 6,000 workers in July 2001. This was less than a month after 80,000 employees had willingly taken (pay cuts). The management also sent memos saying that layoffs would continue and that volunteering for pay cuts] would not guarantee continued employment. According to company insiders, once the merger was implemented, Fiorina was likely to lay off 15,000 to 30,000 employees as a part of a major cost savings drive. With Walter, David and The Foundation opposing the deal, Fiorina was relying on the remaining institutional shareholders (with a 67% stake) to vote in favour of the deal. Fiorina hoped to convince investors by the time the merger was to be voted upon. Interestingly enough, while the merger was being seen as potentially harmful for HP and Compaq, observers, including HP insiders and a number of financial and legal experts in [...] Silicon Valley, said that if the merger was unsuccessful at this point, it could be equally disastrous for the companies involved THE FUTURE Since HP and Compaq had already initiated the integration process, they were privy to many key facts about each other's business. If the merger did not materialize, both the companies were potentially vulnerable to insider information being misused. Also, the companies, as independent entities would face extreme skepticism from the stock markets, which had already shown their disapproval of the proposal. Some industry experts were also worried that Fiorina, Capellas and several key board members and senior executives who had been staunch supporters of the deal, would leave. The merger's failure would also set back the company formally opting out of the deal by $675 million in form of a breakup fee. Analysts also claimed that Compaq would have an especially tough time in the future, as its credibility in the stock market had been badly affected. Another cause of concern was the European Commission expressing fears that the deal would allow HP to dominate PC distribution and therefore fix prices for the entire industry. Investigation were also on by the U.S. antitrust authorities. The only ones to gain out of the whole episode seemed to be the stock market arbitrageurs, who were capitalizing on the short-term volatility of HP and Compaq stocks. Table 1: HP-Compaq Merger Transaction Summary Structure Exchange Ratio fan HP share per Comp share Current Value Approximately $25 billion Ownership HP shareholders 6. Compaqshareholders 3% Mounting Expected Closing First Halfer2000 Key Figures (Previous 4 qtrs - in s billion) HP Combined Total Revenue 87.4 1.5 70.100 Operating Earnings Number of employees Market Capitalisation (as 31/800 Saree HP Pre Release September 8, 2001 SO 45.100 40 15.00 66,104 Table 2: Top 5 Vendors, Worldwide PC Shipments; First Quarter 2001 Vendor 201 Market Q100 Market Market Shipments Share Shipments Share > Growth in 190) Cin 010.) Dell 10 10,4 00 Com 376 119 HP 7.5 2 81 TRES 2004 1.526 Pet 1.773 1.785 61 65 59 Och 17, 30,781 1000 25 All 11.63 1000 Vendors Saree International Data Corporation, April 2001 Table 3: Top 5 Vendors, US PC Shipments: First Quarter 2001 Vendor 901 Market QI 60 Market Market (Rank) Shipments Share Shipments Share) Growth in ) in 800) Dell 1.350 17.1 20 Com 1.600 163 HP 1.035 102 1.415 Gatew 88 1.03 -11.0 IBS 471 4.1 Others ANG 37,0 All Vendors 10.491 100.0 100.0 Saree Internal Corporation, April 2001

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock