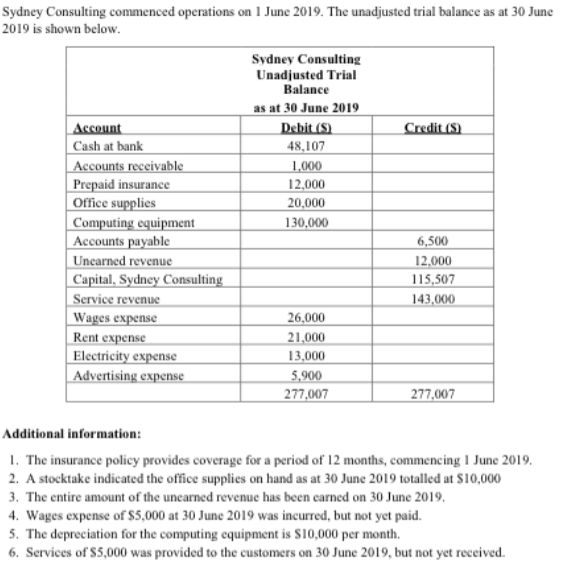

Question: Sydney Consulting commenced operations on 1 June 2019. The unadjusted trial balance as at 30 June 2019 is shown below. Sydney Consulting Unadjusted Trial

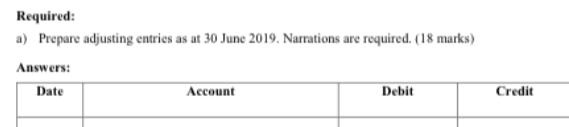

Sydney Consulting commenced operations on 1 June 2019. The unadjusted trial balance as at 30 June 2019 is shown below. Sydney Consulting Unadjusted Trial Balance as at 30 June 2019 Debit (S) 48,107 Credit (S) Account Cash at bank Accounts receivable Prepaid insurance Office supplies |Computing equipment Accounts payable Unearned revenue Capital, Sydney Consulting Service revenue Wages expense Rent expense Electricity expense Advertising expense 1,000 12,000 20,000 130,000 6,500 12,000 115,507 143,000 26,000 21,000 13,000 5,900 277,007 277,007 Additional information: 1. The insurance policy provides coverage for a period of 12 months, commencing 1 June 2019. 2. A stocktake indicated the office supplies on hand as at 30 June 2019 totalled at S10,000 3. The entire amount of the unearned revenue has been earned on 30 June 2019. 4. Wages expense of $5,000 at 30 June 2019 was incurred, but not yet paid. 5. The depreciation for the computing equipment is S10,000 per month. 6. Services of $5,000 was provided to the customers on 30 June 2019, but not yet received. Required: a) Prepare adjusting entries as at 30 June 2019. Narrations are required. (18 marks) Answers: Date Account Debit Credit b) Calculate the updated balances for the following accounts as a result of the adjusting entries in Part a. (2 marks) Answer: Revenue Wages Expense

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Adjusting entries Sydney Consulting Date General Accounts Debit Credit Adjusted Trial Balance 30Jun1... View full answer

Get step-by-step solutions from verified subject matter experts