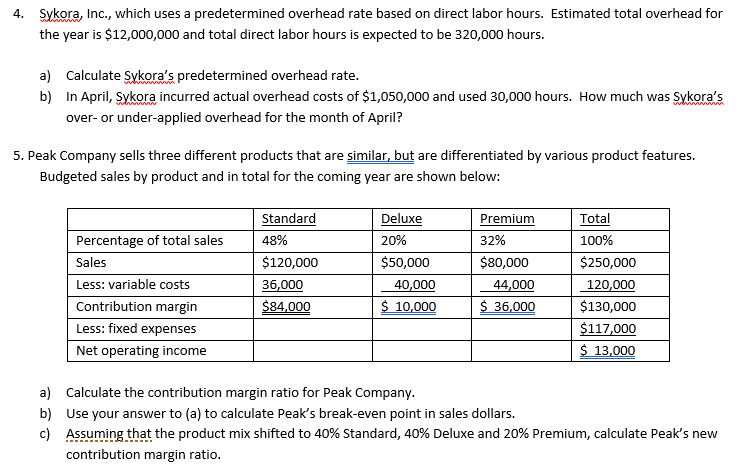

Question: Sykora, Inc., which uses a predetermined overhead rate based on direct labor hours. Estimated total overhead for the year is $12,000,000 and total direct labor

Sykora, Inc., which uses a predetermined overhead rate based on direct labor hours. Estimated total overhead for the year is $12,000,000 and total direct labor hours is expected to be 320,000 hours. 4. a) Calculate Sykora's predetermined overhead rate b) In April, Sykora incurred actual overhead costs of $1,050,000 and used 30,000 hours. How much was Sykora's over- or under-applied overhead for the month of April? 5. Peak Company sells three different products that are similar, but are differentiated by various product features. Budgeted sales by product and in total for the coming year are shown below: Standard 48% $120,000 36,000 $84,000 Deluxe 20% $50,000 Premium 32% $80,000 Total 100% $250,000 Percentage of total sales Sales Less: variable costs Contribution margin Less: fixed expenses Net operating income 44,000 40,000 S 10,000 120,000 $130,000 $117,000 S 13,000 S 36,000 a) b) c) Calculate the contribution margin ratio for Peak Company Use your answer to (a) to calculate Peak's break-even point in sales dollars. Assuming that the product mix shifted to 40% standard, 40% Deluxe and 20% premium, calculate Peak's new contribution margin ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts