Question: synopsys company, choose project 2 Here we do not have provided with the tax struture of the company so for finding out the WACC we

synopsys company, choose project 2

synopsys company, choose project 2

Here we do not have provided with the tax struture of the company so for finding out the WACC we will find out the IRR of the both the project as follow

Project A

IRR

0 = -100 + 70(1+r)1 +50(1+r)2 +20(1+r)3

Solving this equation by trial and error method we will get

WACC of the project A =23.5641

=23.56%

Project B

IRR

0 = -100 + 10(1+r)1 +60(1+r)2 +80(1+r)3

Solving this equation by trial and error method we will get

WACC of the project B =18.1258%

=18.13%

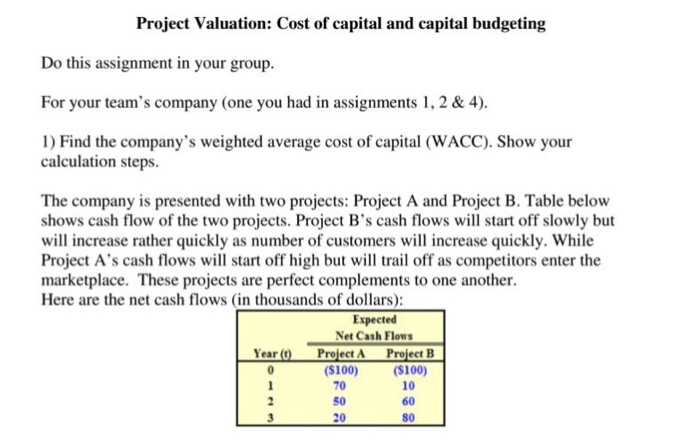

Project Valuation: Cost of capital and capital budgeting Do this assignment in your group. For your team's company (one you had in assignments 1, 2 & 4). calculation steps. The company is presented with two projects: Project A and Project B. Table below shows cash flow of the two projects. Project B's cash flows will start off slowly but will increase rather quickly as number of customers will increase quickly. While Project A's cash flows will start off high but will trail off as competitors enter the marketplace. These projects are perfect complements to one another. Here are the net cash flows (in thousands of dollars): Expected Net Cash Flows Year Project A Project B (S100) (S100) 70 60 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts