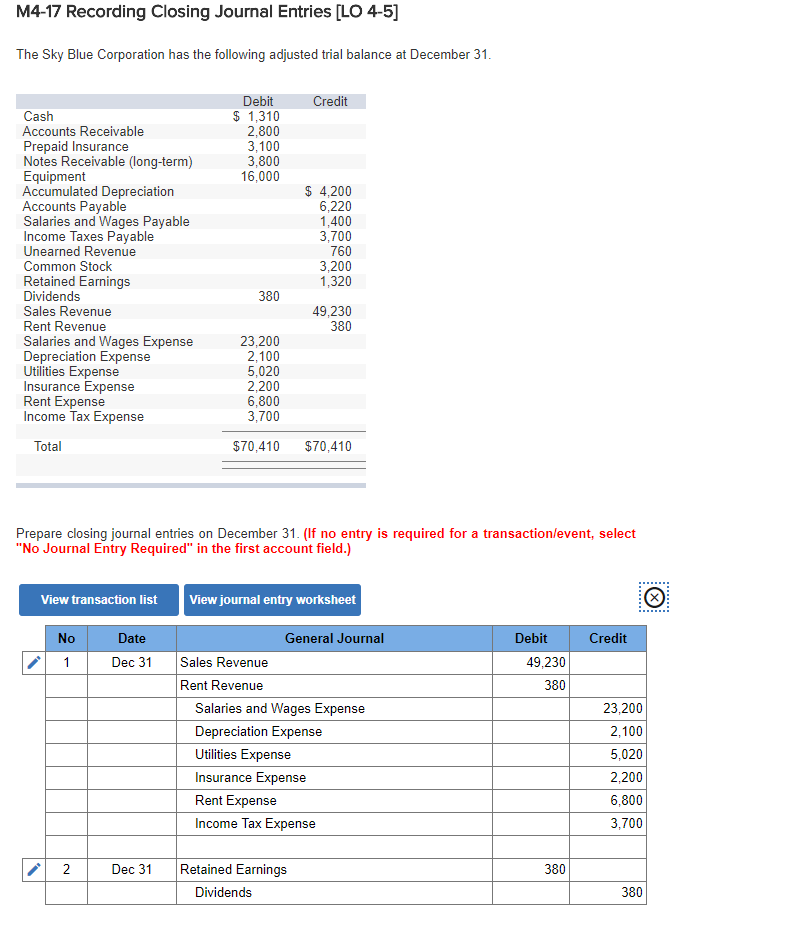

Question: System said the answer is not compeleted. Wondering what is missing, thanks. M4-17 Recording Closing Journal Entries LO 4-5] The Sky Blue Corporation has the

![thanks. M4-17 Recording Closing Journal Entries LO 4-5] The Sky Blue Corporation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e302a30b931_37866e302a29f9b7.jpg)

System said the answer is not compeleted. Wondering what is missing, thanks.

M4-17 Recording Closing Journal Entries LO 4-5] The Sky Blue Corporation has the following adjusted trial balance at December 31 Debit Cash Accounts Receivable Prepaid Insurance Notes Receivable (long-term) Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Rent Revenue Salaries and Wages Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Income Tax Expense $1,310 2,800 3,100 3,800 16,000 $ 4,200 6,220 1,400 3,700 760 3,200 1,320 380 49,230 380 23,200 2,100 5,020 2,200 6,800 3,700 Total $70,410 $70,410 Prepare closing journal entries on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet 0 Date General Journal Debit Credit Dec 31 Sales Revenue 49,230 Rent Revenue 380 Salaries and Wages Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Income Tax Expense 23,200 2,100 5,020 2,200 6,800 3,700 Dec 31 Retaied Earnings 380 Dividends 380

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts