Question: system. What would you recommend that Bastile do to fix the problems? EXERCISE 16.9 Preparing an Income Statement Using the Cost of Finished Goods Manufactured

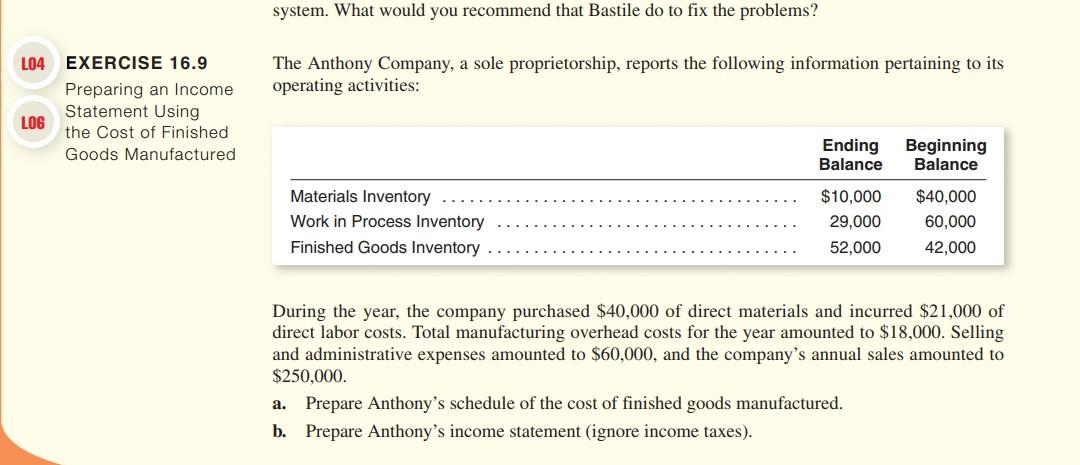

system. What would you recommend that Bastile do to fix the problems? EXERCISE 16.9 Preparing an Income Statement Using the Cost of Finished Goods Manufactured The Anthony Company, a sole proprietorship, reports the following information pertaining to its operating activities: During the year, the company purchased $40,000 of direct materials and incurred $21,000 of direct labor costs. Total manufacturing overhead costs for the year amounted to $18,000. Selling and administrative expenses amounted to $60,000, and the company's annual sales amounted to $250,000. a. Prepare Anthony's schedule of the cost of finished goods manufactured. b. Prepare Anthony's income statement (ignore income taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts