Question: t assessment 0 : 0 6 : 4 7 elapsed Nolan Ltd . is considering upgrading its office equipment. The cost of this upgrade will

t assessment

:: elapsed

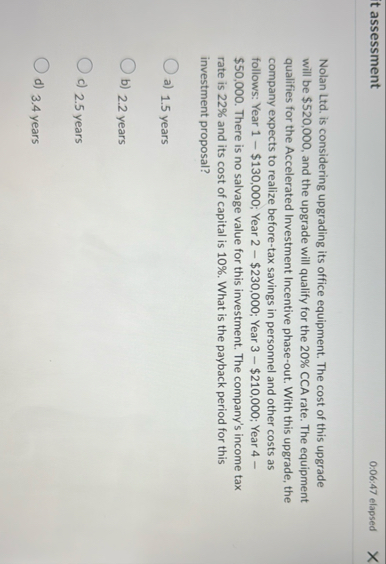

Nolan Ltd is considering upgrading its office equipment. The cost of this upgrade will be $ and the upgrade will qualify for the CCA rate. The equipment qualifies for the Accelerated Investment Incentive phaseout. With this upgrade, the company expects to realize beforetax savings in personnel and other costs as follows: Year $; Year $; Year $; Year $ There is no salvage value for this investment. The company's income tax rate is and its cost of capital is What is the payback period for this investment proposal?

a years

b years

c years

d years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock