Question: t . blackboardcdn.com / 5 ddb 1 0 8 fe 0 c 4 2 / 2 6 4 5 9 2 6 3 ? X

tblackboardcdn.comddbfecXBlackboardSBucketlearnapsoutheastpro...

You have $ and a bank is offering interest on deposits. If you deposit the money in the bank, how much will you have in one year

You are an international fish trader. A food producer in the Czech Republic offers to pay you two million Czech koruna today in exchange for a year's supply of frozen fish. Your Thai supplier will provide you with the same supply for three million Thai baht today. If the current competitive market exchange rates are koruna per dollar and

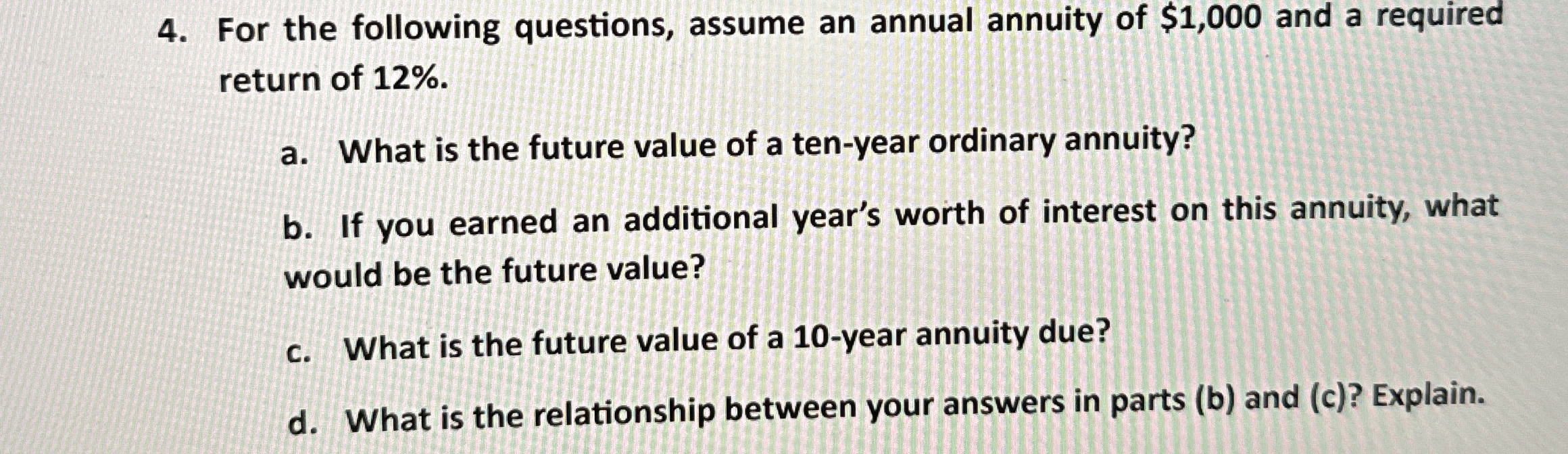

For the following questions, assume an annual annuity of $ and a required return of

a What is the future value of a tenyear ordinary annuity?

b If you earned an additional year's worth of interest on this annuity, what would be the future value?

c What is the future value of a year annuity due?

d What is the relationship between your answers in parts b and c Explain.per dollar, what is the value of this exchange to you?

For the following questions, assume an annual annuity of $ and a required return of

a What is the future value of a tenyear ordinary annuity?

b If you earned an additional year's worth of interest on this annuity, what would be the future value?

c What is the future value of a year annuity due?

d What is the relationship between your answers in parts b and c Explain.

Kim Edwards and Hiroshi Suzuki are both newly minted yearold MBAs. Kim plans to invest $ per month into her defined contribution superannuation plan beginning next month. Hiroshi intends to invest $ per month into his super plan, but he does not plan to begin investing until years after Kim begins investing, Both Kim and Hiroshi will retire.atage. and theicsuper plans average.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock